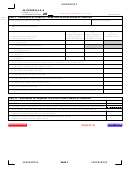

PA SCHEDULE G-R

Reconciliation of Taxes Paid to

Other States or Countries

PA-40 G-R (10-11) (FI)

PA DEPARTMENT OF REVENUE

The purpose of PA Schedule G-R is to summarize all PA Schedules G-S and/or G-L filed with the PA-40, Pennsylvania Personal Income Tax Return,

in order for the Department to be able to provide other state income tax data to states requesting the information. PA Schedule G-R must be com-

pleted or any credits listed on PA Schedules G-S and/or G-L will be denied. PA Schedule G-R and PA Schedules G-S or G-L are required to be includ-

ed with all PA-40 returns claiming the Resident Credit on Line 22 of the PA-40 return.

IMPORTANT: Do not submit this schedule with Form PA-41, Pennsylvania Fiduciary Income Tax Return, or Form PA-20S/PA-65, PA S

Corporation/Partnership Information Return.

INSTRUCTIONS

Enter amounts in whole dollars only.

IMPORTANT: If you claim a resident credit on PA Schedule G-S or PA Schedule G-L, you will need those schedules to complete PA Schedule G-R.

Line a. Enter the name of the taxpayer claiming the credit from the PA Schedules G-S and/or G-L. Enter the Social Security Number of the tax-

payer listed first on the PA-40 return.

Line b. Enter the Social Security Number of the taxpayer claiming the credit.

CAUTION: You cannot file a joint PA Schedule G-R unless you are able to file a joint PA Schedule G-S or PA Schedule G-L.

Line c. If more than one PA Schedule G-R is required to list all the states or countries in which a taxpayer is claiming a resident credit for taxes

paid to another state or country, enter the number of PA Schedules G-R included by the taxpayer shown on Line b.

Line d. Enter the totals for Columns C, D, and E by adding Line 21 for each PA Schedule G-R included by the taxpayer shown on Line b. Enter the

amount from Column E on Line 22 of the PA-40 return.

Column A. For Lines 1 through 20, enter the two-character state or jurisdiction U.S. Postal Code for each state or country in which you claimed a

credit for taxes paid. Use the following list of U.S. Postal Codes to complete this column:

Alabama

AL

Kansas

KS

New Jersey

NJ

Virginia

VA

Arizona

AZ

Kentucky

KY

New Mexico

NM

Washington, DC

DC

Arkansas

AR

Louisiana

LA

New York

NY

West Virginia

WV

California

CA

Maine

ME

North Carolina

NC

Wisconsin

WI

Colorado

CO

Maryland

MD

North Dakota

ND

American Samoa

AS

Connecticut

CT

Massachusetts

MA

Ohio

OH

Guam

GU

Delaware

DE

Michigan

MI

Oklahoma

OK

Northern Mariana Island

MP

Georgia

GA

Minnesota

MN

Oregon

OR

Puerto Rico

PR

Hawaii

HI

Mississippi

MS

Rhode Island

RI

U.S. Virgin Islands

VI

Idaho

ID

Missouri

MO

South Carolina

SC

All Other Foreign Countries OC

Illinois

IL

Montana

MT

Tennessee

TN

Indiana

IN

Nebraska

NE

Utah

UT

Iowa

IA

New Hampshire

NH

Vermont

VT

CAUTION: Do not use any codes other than the two-character codes listed above. The Department will not recognize any other codes. Use

of other codes may result in denial of credits and/or notices from PA or other states. For example, when using “various” to claim

the resident credit for taxes paid to other foreign countries on PA Schedules G-S or G-L, the only acceptable code is “OC.” In this

instance “VA” for various is not acceptable nor is “FC” for foreign country. In addition, “VAR” or “VA” is not an acceptable code for

reporting credits from multiple states on PA Schedule G-S or G-L. “VA” is acceptable only for reporting credits from Virginia. A

separate PA Schedule G-S or G-L must be completed for each state, and each state must be reported as a separate line item on

PA Schedule G-R.

Column B. For Lines 1 through 20, fill in the oval if the return filed in the other state or country was filed as part of a consolidated, composite or

group filing. A consolidated, composite or group filing will be indicated on Line 1 of the PA Schedule G-L.

NOTE: If the credit being claimed was passed through from a PA S Corporation or was as a result of a return filed on behalf of the part-

ner by a partnership, fill in this oval.

Column C. For Lines 1 through 20, you must obtain the amount of income subject to tax in the other state or country from PA Schedule G-S or

PA Schedule G-L. If you are filing and including PA Schedule G-S, add the amounts from Lines 2c through 2e for Column B of PA Schedule G-S.

If you are filing and including PA Schedule G-L, add the amounts from Lines 2c through 2j for Column B of PA Schedule G-L. For Line 21, add the

amounts on Lines 1 through 20 in Column C and enter the amount in the space provided.

NOTE: If an amount on Lines 2f, 2g, or 2h on PA Schedule G-L indicates a loss, add the loss with the income reported on Lines 2c, 2d,

2e, 2i and 2j.

Column D. For Lines 1 through 20, enter the amount of tax paid to the other state or country from Line 4b of each PA Schedule G-S or PA Schedule

G-L. For Line 21, add the amounts on Lines 1 through 20 in Column D and enter the amount in the space provided.

Column E. For Lines 1 through 20, enter the amount of the credit allowable for PA from Line 6 of each PA Schedule G-S or PA Schedule G-L. For

Line 21, add the amounts on Lines 1 through 20 in Column E and enter the amount in the space provided.

IMPORTANT: Do not use FC for foreign countries not listed. Do not use VAR for various. Using incorrect codes may result in erroneous billings by

other states.

RETURN TO FORM

1

1 2

2