Return To Form

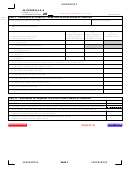

PA SCHEDULE G-S

PA-40 G-S (10-12) (FI)

PA DEPARTMENT OF REVENUE

interest and dividend income all subject to tax in the same

Column B. Enter the amount from Line 2a, Column B.

country must report their income and tax on a separate PA

Column C. Compare Line 2c, Column A, with Line 2c,

Schedule G-S for the compensation. The couple may include

Column B and enter the lesser of the two amounts here. You

the interest or dividend income on a separately prepared

cannot claim more wages subject to tax in other states or

combined PA Schedule G-S for the interest or dividend

countries than are subject to tax in PA. Also, you cannot

income or include one-half of the interest and dividend

claim that retirement benefits withheld or paid for by your

income on each separately prepared PA Schedules G-S.

employer are subject to tax in any state or country other

Also see “Special Instructions for Taxpayers Reporting

than PA.

Amounts on PA-40 Line 10, Other Deductions” on Page 4 of

INTEREST AND DIVIDENDS

these instructions.

Lines 2d and 2e

IMPORTANT: When using fractions or ratios to deter-

Column A. If you are claiming a resident credit for taxes

mine any amounts for this schedule, calculate out to

paid on foreign interest and/or dividend income, enter the

six decimal places.

total amounts of interest and/or dividend income subject to

Line 1. Enter the name of the other state or country to which

tax in PA on Lines 2d and/or 2e from Lines 2 and 3 of your

you owed/paid income tax. A separate PA Schedule G-S

PA-40 return.

should be filed for each state or country in which you claim a

Column B. If you have interest and/or dividend income

resident credit. Do not enter Pennsylvania. Taxpayers claiming

subject to tax in another country, enter the interest or

a credit for foreign taxes paid only on interest and dividend

dividend income subject to tax in the other countries on the

income may combine the income and taxes from various

respective lines. You may combine amounts of income and

countries and write “VARIOUS” on Line 1. However, a sepa-

taxes from various countries and include it all on one PA

rate statement must be included to illustrate the amounts of

Schedule G-S. However, you must include a separate state-

income and taxes paid for each country in order to receive

ment to illustrate the amounts of income and taxes paid for

credit for the combined amounts reported. You may not claim

each country in order to receive credit for the combined

a credit for interest or dividend income subject to tax in

amounts reported. You must also calculate the allowable

another country on which no income tax was paid.

credit on a country-by-country basis on this statement prior to

entering the amounts on the PA Schedule G-S. The statement

COMPENSATION

showing the amounts of income, tax paid and credit calculated

Line 2a

on a country-by-country basis may show the name of stock,

Column A. If a taxpayer or spouse has compensation subject

type of income or transaction taxed in lieu of the country’s

to tax in another state or country, enter the amount of gross

name.

compensation subject to tax in PA from Line 1a of the PA-40.

Otherwise, leave this area blank. Report only the compensation

NOTE: Individual taxpayers should add Lines 2c, 2d and 2e

attributable to the name at the top of the PA Schedule G-S.

of Column B and enter the total on PA Schedule G-R, in Column

C of one of Lines 1 through 20. Losses may be offset against

Column B. If a taxpayer has income subject to tax in another

gains in this total, as long as offsetting is allowed in the other

state or country, enter the amount of gross compensation

state or country.

subject to tax in the other state or country from the other

CAUTION: If you have interest and/or dividend income clas-

state or country’s return. Include a copy of Form W-2 and/or

other documentation supporting the position that compensa-

sified as business or rental income and subject to tax in

tion is subject to tax in the other state or country. If Form W-2

another state, you must use PA Schedule G-L to claim the

shows an amount different than the amount of compensation

credit on that income. Also, if you claim a credit for taxes paid

reported on the return as taxable to the other state or country,

to a foreign country on interest and/or dividend income, that

include a copy of the other state or country’s apportionment

income must be classified as interest and/or dividend income

schedule or a copy of a supplementary statement illustrating

in PA to claim the income on these lines of PA Schedule G-S.

how the compensation subject to tax on the return for the

Column C. Compare the amounts on Lines 2d and 2e from

other state or country was determined. If the amount of

Columns A and B. Enter the lesser of the two amounts.

compensation shown on the W-2 is greater than the amount

Line 3. Add the amounts on Lines 2c through 2e for Column

of compensation reported as subject to tax on the return for

C and enter the result here. If you have amounts on lines 2d

the other state or country, you must use the amount reported

and/or 2e for Column C, you should not have an amount on

on the return.

Line 2c for Column C, unless the amounts on Lines 2d and 2e

Enter only the taxpayer’s or spouse’s portion of the compen-

for Column C are from one country and are from the same

sation subject to tax in the other state or country. You must

country as the amount for line 2c for Column C.

file a separate PA Schedule G-S and PA Schedule G-R to

Line 4a. Enter the amount of income tax reported to the other

claim credit for the other spouse’s compensation that was

state or country as due and payable before any credits for

taxed in another state or country.

taxes withheld, estimated tax payments or other payments

Column C. No entry is required.

are taken into account. This amount is generally the tax

liability as determined on the other state’s return. However,

Line 2b

any special tax credits awarded or claimed must be used to

Column A. If Line 2a, Column A, is completed and the tax-

reduce this amount.

payer or spouse claimed unreimbursed business expenses,

enter the amount of unreimbursed business expenses from

Line 4b. Enter the amount of income tax paid to the other

Line 1b of the PA-40. Enter only the unreimbursed business

state or country in the form of estimated taxes, withholding

expenses attributable to the name at the top of the PA

taxes, extension payments and other payments (additional

Schedule G-S. Otherwise leave this line blank.

assessments of taxes). Other payments include payments

that you intend to make with the filing of the return if there

Column B. No entry is required.

is a balance due after the application of estimated taxes,

Column C. No entry is required.

withholding taxes, and extension payments. If you do not

Line 2c

make the payment of taxes due with the return or intend to

Column A. Subtract Line 2b, Column A, from Line 2a,

make the payment, do not include the balance due on the

Column A. Enter the result here.

return with this amount.

PAGE 3

1

1 2

2 3

3 4

4