Return To Form

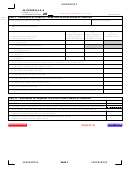

PA SCHEDULE G-S

PA-40 G-S (10-12) (FI)

PA DEPARTMENT OF REVENUE

Individual taxpayers: the amount on Line 4b of each PA

Line 4. Subtract Line 3 from 1.000000. Calculate the

Schedule G-S or G-L should be carried to PA Schedule G-R,

amount to six decimal places.

in Column D on one of Lines 1 through 20.

Line 5. Multiply the amount on Part II, Line 4 by the

amount on Part I, Line 4c. Enter the result here and

Line 4c. Enter the lesser of Line 4a or 4b.

on Part I, Line 4d.

Line 4d. If a taxpayer has more compensation income subject

to tax in the other state or country than in PA (Line 2c, Column

SPECIAL INSTRUCTIONS FOR TAXPAYERS

B is greater than Line 2c, Column A), an adjustment to the

REPORTING AMOUNTS ON PA-40 LINE 10,

amount of tax paid to the other state is required. Subtract

OTHER DEDUCTIONS

Line 2c, Column A from Line 2c Column B, and divide the

For taxpayers with amounts reported on Line 10, Other

result by Line 2c, Column B. Multiply that ratio by the

Deductions, amounts listed in Column A for each line (Lines

amount on Line 4c, and enter the product here.

2c through 2e for Column A) must be reduced by a pro-rata

amount of the deduction attributable to the taxpayer (or

Line 4e. Subtract Line 4d from Line 4c, and enter the result

spouse) claiming the credit.

here.

Example: Andy and Timi Taxpayer have compensation of

Line 5. Multiply Line 3 by 3.07 percent (0.0307) and enter

$90,000 and $94,000 respectively reported on their joint

the result here.

PA-40 return. They do not claim any business expenses on

Line 6. Individual taxpayers must enter the lesser of Line 4e

PA Schedule UE. The Taxpayers also report $6,000 of joint

or Line 5 here and in Column E on one of Lines 1 through 20

interest income and $10,000 of joint dividend income. In addi-

of PA Schedule G-R. Estates and trusts must total the allow-

tion, Andy and Timi’s work requires them to spend 95 percent

able credit from Line 6 of all PA Schedules G-S and/or G-L

of their time in the Delaware offices of their respective

and enter the total on Line 13 of Form PA-41, the fiduciary

employers. The Taxpayers have one child and they contribute

income tax return.

$12,000 each to the IRC Section 529 plan for that child.

Example: Mary has compensation of $400,000 in PA. Mary’s

On their joint tax return, the Taxpayers report a total

employer requires her to work out of the office in

of $200,000 of total PA taxable income on Line 9 of their

Philadelphia as well as at the company’s offices in Dover,

PA-40 return and $24,000 on Line 10. Andy and Timi’s

Delaware. Mary incurs travel expenses and meals and enter-

shares of the income on Line 9 are $98,000 and $102,000,

tainment expenses of $50,000, for which her employer does

respectively. The income by class of income also differs for

not provide reimbursement. Mary pays taxes of $10,500 on

Andy and Timi. Andy’s share of income for each class is as

wages of $360,000 for the time she spends in her company’s

follows: Compensation - $90,000; Interest - $3,000; and

Delaware office. Mary must make an adjustment to her taxes

Dividends - $5,000. Timi’s share of income for each class is

paid to Delaware of $292 ([360,000-350,000]/360,000 x

as follows: Compensation - $94,000; Interest - $3,000; and

10,500 = 292), as the amount she would report on Line 2c,

Dividends - $5,000.

Column B is more than the amount she would report on Line

Andy and Timi would report the following amounts in Column

2c, Column A. Mary would be entitled to a credit of $10,208

A of their separately completed PA Schedules G-S:

for the taxes paid to Delaware. Mary also has investments in

stocks and bonds in several international companies and

Andy

Timi

receives interest and dividend income from those companies.

Line 2c - $78,980

$82,941

Before she receives the interest and dividend income from

Line 2d - $2,633

$2,647

those companies, they are required to withhold the taxes

Line 2e - $4,387

$4,412

that would be due to the country where the companies are

The amounts reported on each line of Column A for Andy and

headquartered. All but one of the foreign countries in which

Timi are reduced by subtracting from the amounts reported in

she has investments in companies levies a tax. Mary can

each class of income on Form PA-40 Andy or Timi’s share of

claim the credit for taxes paid on the interest and dividend

the income from each class of income divided by their respec-

income to the foreign countries on a separately prepared PA

tive shares of the total income for all classes and multiplied by

Schedule G-S. However, Mary must provide with that PA

their respective shares of the amount on Form PA-40 Line 10.

Schedule G-S a statement providing a list of the countries,

For example, Line 2c for Andy was determined by subtracting

amounts of interest and dividend income subject to tax in

from the $90,000 he reported as compensation $11,020,

each country, the tax paid in each country and the amount

which is $90,000 divided by $98,000 times $12,000.

of the resident credit (lesser of 3.07 percent or tax paid) for

The amounts reported in Column B for each of their

each country on a country-by-country basis. Mary may not

Schedules G-S would be as follows:

claim a credit for taxes paid to the country in which her

interest or dividend income was not taxed.

Andy

Timi

Line 2c - $85,500

$89,300

Part II

Line 2d - $0

$0

Instructions for the Worksheet for Adjusted Tax Paid

Line 2e - $0

$0

in Other States or Countries

Because of the respective pro-rata reductions required for

Line 1. Enter the amount from Part I, Column C, Line 3 here.

Column A, the respective amounts for Column C (the lesser

of Column A or Column B) for Andy and Timi are as follows:

Line 2. Add the amounts from Part I, Column B, Lines 2c

through 2e. Enter the result here.

Andy

Timi

Line 2c - $78,980

$82,941

Line 3. Divide the amount on Line 1 by the amount on Line

Line 2d - $0

$0

2. Calculate the amount to six decimal places. If the

Line 2e - $0

$0

result of dividing Line 1 by Line 2 equals 1.000000,

you are not required to make an adjustment to

The total incomes for which credits may be claimed on

taxes. You do not have to complete Lines 4 and 5 of

separate Schedules G-S (Line 3 on the Schedules G-L) are

this section. Stop here and enter a 0 on Part I, Line 4d.

$78,980 for Andy and $82,941 for Timi.

PAGE 4

1

1 2

2 3

3 4

4