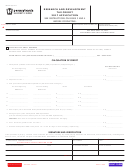

Form Srdtc-1 - Strategic Research And Development Tax Credit Page 6

ADVERTISEMENT

Divide the amount on line 8 by the number of entries on

Enter the lesser of $2 million, the amount on Line 18, the

9 9

19 19

line 7 [i.e., 3, 2 or 1] and enter here. If you skipped Lines

amount on Line 15 less any credit claimed on Line 17, or

7 and 8, enter $0 on this line.

the amount of available credit you wish to use to offset Corporation

Net Income Tax here.

Subtract the amount on Line 9 from the amount on Line

10 10

6 and enter here. If the calculated amount is less than $0,

Enter your total amount of Personal Income Tax liability

20 20

enter $0 on this line.

on the conduit income directly derived from the qualified

Strategic Research and Development pass through entity [e.g.,

if $500,000 out of $2,000,000 in total adjusted gross income is

Multiply the amount on Line 10 by 10% [0.10] and enter

11 11

attributable to income from the qualified business entity, then

the result here.

$2,000,000) of total personal income tax

25% ($500,000/

Multiply the amount on Line 6 by 3% [0.03] and enter

liability should be entered here].

12 12

the result here.

Enter the lesser of $2,000,000, the amount on Line 20,

21 21

Research and Development companies enter the greater

the amount on Line 15 less any credit claimed on Line 17

13 13

of the value on Line 11 or the value on Line 12 here.

and Line 19, or the amount of available credit you wish to use to

Owners allocated Strategic Research and Development Tax

offset Personal Income Tax here.

Credit enter the current year credit allocated from a Research and

Development company. This amount represents the total new tax

Sum the amounts of credit claimed on Line 17, Line 19

22 22

credit for this year.

and Line 21, and enter the result here. The sum cannot

exceed $2 million.

Enter the value of unused Strategic Research and

14 14

Development Tax Credit carried forward from prior

Subtract the amount on Line 22 from the amount on

23 23

years. [Note that credit carryovers cannot exist until TY2004].

Line 15, and enter the result here. This amount can never

be less than $0. Unused credit may be carried over for a period not

Add the amount on Line 13 and Line 14, and enter

to exceed ten years.

15 15

the result here. This amount is the total available credit

available for use this year.

If any Strategic Research and Development Tax Credit is

24 24

companies),

allocated to a parent company (or parent

Enter your total amount of Business Franchise Tax

enter the owner name, owner FEIN, owner share of

16 16

liability remaining after deductions for the Subsidiary

ownership and the Strategic Researchand Development

Credit and Business and Occupation Tax Credit.

Tax Credit allocated. Sum all allocated credit amounts

and enter the amount on the Total Allocated line.

Enter the lesser of $2 million, the amount on Line 16, the

17 17

amount on Line 15, or the amount of available credit you

wish to use to offset Business Franchise Tax here.

Subtract the amount on the Total Allocated line (from

25 25

the Allocated to Owners section) from the amount on

Line 23.

18 18

Enter your total amount of pre-credit Corpora-

tion Net Income Tax liability.

Recap of the use of Strategic Research and Development

26 26

Tax Credits over the past eleven years and the total

amount to be carried over to next year.

3

4

4

t

t

Rev. 9/12

Rev. 9/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6