Form Dr-501cc - Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Page 2

ADVERTISEMENT

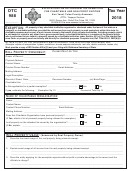

DR-501CC

INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION

R. 11/12

PROPRIETARY CONTINUING CARE FACILITY

Page 2

Section 196.1977, F.S.

State of Florida

County of

COMPLETED BY EACH RESIDENT

Resident name

Tax Year 20

Facility name

Unit. number

Did you live in this unit on Jan. 1 of the tax year and consider it your permanent home?

yes

No

Do you have a continuing care contract as defined in Chapter 651, F.S.?

yes

No

Have you claimed homestead exemption on any other property for the current year?

yes

No

yes

No

Did you file for tax exemptions last year?

If yes, where

If no, your last year’s address

I swear the above is true and correct. I understand that by applying for this exemption as a resident of

a proprietary continuing care facility, I may not claim any other homestead exemption for this tax year.

Signature, resident

Date

State of Florida

County of

This statement was sworn and subscribed before me this date,

by ________________________________

who is personally known to me or who has produced

as type of identification.

_______________________________________

Notary Public Signature and Seal

NOTICE TO RESIDENT

This facility must tell you how much they will save in taxes from this exemption. The facility must

lower your maintenance fee by the full amount. They must lower your fee every month, or lower your

fee one time for the entire year.

Any person who knowingly and willfully gives false information to claim homestead exemption is guilty

of a misdemeanor of the first degree, punishable by imprisonment up to 1 year or a fine up to $ 5,000,

or both, see Section 196.131(2), F.S.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2