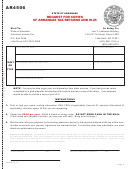

Arkansas Individual Income Tax Forms And Instructions - 2013 Page 10

ADVERTISEMENT

DEFINITIONS

GROSS INCOME

Gross income is any and all income (before deductions) other than the kinds of income specifically described as exempt from tax on

pages 11 and 12 “Exempt From Income Tax”.

Exception: The $6,000 exemption on retirement income and the $9,000 exemption on military income as described on

page 12 are included in gross income.

DOMICILE

This is the place you intend to have as your permanent home and the place you intend to return to whenever you are away. You can

have only one domicile. Your domicile does not change until you move to a new location which you intend to make your permanent

home. If you move to a new location but intend to stay there only for a limited time (no matter how long), your domicile does not change.

This also applies if you are working in a foreign country.

FULL YEAR RESIDENT

You are a full year resident if you lived in Arkansas all of calendar year 2013, or if you have maintained a domicile or Home of Record

in Arkansas during the tax year.

NONRESIDENT

You are a nonresident if you did not make your domicile in Arkansas.

PART YEAR RESIDENT

You are a part year resident if you established a domicile in Arkansas or moved out of the state during calendar year 2013.

MILITARY PERSONNEL

If Arkansas is your Home of Record (HOR) and you are stationed outside the State of Arkansas, you are still required to file an AR1000F

reporting all of your income, including U.S. Military Compensation. If you are stationed in Arkansas and your Home of Record is another

state, Arkansas does not tax your U.S. Military Compensation.

U.S. Military compensation includes wages received from the Army, Navy, Air Force, Marine Corps, Coast Guard, National Guard, Re-

serve Units, and the U.S. Public Health Service.

DEPENDENTS

You may claim as a dependent any person who received over half of his or her support from you, earned less than $3,900 in gross

income, and was your:

Child

Stepchild

Mother

Father

Grandparent

Brother

Sister

Grandchild

Stepbrother

Stepsister

Stepmother

Stepfather

Mother-In-Law

Father-In-Law

Brother-In-Law

Sister-In-Law

Son-In-Law

Daughter-In-Law

Or, an individual (other than your spouse) who, for the tax year of the taxpayer, had the same principal place of abode as the taxpayer

and was a member of the taxpayer’s household. Or, if related by blood: Uncle, Aunt, Nephew, Niece. The term “dependent” includes

a foster child if the child had as his principal place of abode the home of the taxpayer and was a member of the taxpayer’s household

for the taxpayer’s entire tax year.

The term “dependent” does not apply to anyone who is a citizen or subject of a foreign country UNLESS that person is a resident of

Mexico or Canada.

If your child/stepchild was under age 19 at the end of the year, the $3,900 gross income limitation does not apply. Your child/step-

child may have earned any amount of income and still be your dependent if the other dependency requirements in this section were met.

If your child/stepchild was a student under age 24 at the end of the calendar year, the $3,900 gross income limitation does

not apply. The other requirements in this section still must be met.

To qualify as a student, your child/stepchild must have been a full-time student for five (5) months during the calendar year at a

qualified school, as defined by the Internal Revenue Service.

If your dependent died during the tax year, you may claim the full amount of tax credit for the dependent on your tax return regard-

less of when the death occurred during the year.

Arkansas has adopted Internal Revenue Code

151(c)(6) regarding the tax treatment of kidnapped children.

§

Page 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25