Arkansas Individual Income Tax Forms And Instructions - 2013 Page 18

ADVERTISEMENT

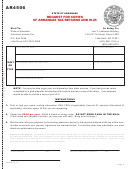

INSTRUCTIONS FOR

INTEREST EXPENSE

LINE 14. In addition to other contributions, a de-

duction is allowed for the donated value of artistic,

ITEMIZED

literary, and musical creations if the following

LINE 8A. You may deduct the home mortgage

qualifications are met:

interest paid to a bank or other financial institution.

DEDUCTIONS

(FORM AR3)

1. The taxpayer making the donation derived at

The deduction is generally limited to interest at-

least fifty percent (50%) of his/her current

tributable to a debt for not more than the cost

or prior year income from an art related profes-

of the principal, and/or second residence, plus

sion;

improvements.

MEDICAL AND DENTAL EXPENSES

2. The fair market value of the art work has

List only amounts you paid and for which you were

been verified by an approved independent

LINE 8B. Enter qualified mortgage insurance

not reimbursed.

appraiser, and a copy of the appraisal

premiums (PMI) paid in 2013. You cannot deduct

is attached;

your mortgage insurance premiums if the amounts

on Form AR1000F/AR1000NR, Line 24 total more

LINE 1. Enter total medical and dental expenses,

3. The artwork was donated to a museum, art gal-

than $109,000 ($54,500 if married filing separate-

less reimbursements from insurance or other

lery, or nonprofit charitable organization quali-

ly). If the amounts on Form AR1000F/AR1000NR,

sources. See chart on Page 19 for examples of

fied under Internal Revenue Code § 501(C)(3)

Line 24 total more than $100,000 ($50,000 if mar-

deductible and nondeductible expenses.

and located in the State of Arkansas; and

ried filing separately), your deduction is limited. See

worksheet on Page 20 to figure your deduction.

4. The deduction for donated art work does

not exceed fifteen percent (15%) of the

LINE 2. Enter total amount from Form AR1000F/

donor’s gross income in the calendar year of

LINE 9. Deduct home mortgage interest paid

AR1000NR, Lines 24A and 24B.

donation.

to an individual on this line, and list that person’s

name and address.

LINE 3A. If you and your spouse were under the

LINE 15. List other deductible contributions:

age of 65 at the end of 2013, multiply Line 2 by

10% (.10). Otherwise enter zero (0).

LINE 10. Enter the amount of deductible points

1.

Unreimbursed amounts spent to maintain an

paid on this line. Deductible points are those that:

elementary or high school student (other than

LINE 3B. If either you or your spouse were age

a dependent or relative) in a taxpayer’s home

65 or over at the end of 2013, multiply Line 2 by

1.

Are incurred in the purchase or improvement

under a program sponsored by a charitable

7.5% (.075). Otherwise enter zero (0)

of the taxpayer’s principal residence; and

organization.

2.

Reflect an established business practice

2.

A gift of property to a non-profit organization.

of charging points in the geographical area

LINE 4. Subtract Lines 3A and 3B from Line 1.

Attach a description of the property, date of

where the loan is made; and

gift, and method of valuation. For each gift in

excess of $500, list any conditions attached

3.

Do not exceed the number of points generally

TAXES

to the gift, manner of acquisition, and cost or

charged for the type of transaction. (Points

basis if owned by you for less than five (5)

paid in refinancing a mortgage must be am-

years.

LINE 5. You may deduct real estate taxes you

ortized over the life of the loan.)

paid on property you own that was not used for

NOTE:

Payments to private academies or other

NOTE:

business. Do not include any special assessments

In order to deduct the full amount of the

schools for the education of dependents

or levy taxes.

points paid, payment of the points must

are not deductible as contributions.

be made from separate funds brought

Some taxes you cannot deduct are:

to the loan closing.

LINE 16. If you made contributions in excess

Arkansas income taxes

of fifty percent (50%) of your adjusted gross

Car tags

LINE 11. Enter deductible investment interest.

income, you may carry the excess deduction over

Cigarette and beverage taxes

The deduction is limited to the amount of invest-

for a period of five (5) years.

Dog licenses

ment income. Interest that is disallowed because of

Estate taxes

the limitation can be carried forward to the next year

If you are deducting an excess contribution from

Federal income taxes

and deducted to the extent of the limitation in the

a previous year, enter the amount and year of the

carryover year. Attach federal Form 4952.

Federal Social Security taxes

original contribution.

Hunting and fishing licenses

Improvement taxes

Sales taxes

LINE 12. Add Lines 8A, 8B, 9, 10, and 11.

LINE 17. Add lines 13, 14, 15, and 16.

LINE 6. You may deduct on this line:

CONTRIBUTIONS

CASUALTY AND THEFT LOSSES

City income taxes

LINE 13. Enter the total contributions you made

Mississippi gambling taxes

by cash or check. If you gave $3,000 or more to

Personal property taxes

LINE 18. The method of computing casualty or

any one organization, list the donee and amount

Taxes paid to a foreign country on income

theft losses is the same as the federal method

given. If you have non-cash contributions of $500

taxed on this return

$100

with the

exclusion. The amount of each

or more, attach federal Form 8283.

loss must exceed ten percent (10%) of your

adjusted gross income. Attach federal Form

LINE 7. Add the amounts on Lines 5 and 6.

4684 and provide necessary supporting

documents.

If you have a Disaster Loss in 2014 on property in

a federal disaster area, you may elect to deduct the

loss as an itemized deduction in 2013. If you elect

to report the loss on your 2013 return, you cannot

report the loss on your 2014 return.

Page 18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25