Arkansas Individual Income Tax Forms And Instructions - 2013 Page 12

ADVERTISEMENT

not result from a debt issued by the United

METHOD A.

List your income separately under

Gambling winnings from Arkansas elec-

States, the State of Arkansas, or any political

Column A (“Your Income”). List your

tronic games of skill are not included

subdivision of the State of Arkansas.) Interest

spouse’s income separately under

as income and the 3% withholding is

from government securities paid to individuals

Column B (“Spouse’s Income”).

excluded from Line 37. To determine if

through a mutual fund is exempt from tax.

Figure your tax separately and

your gambling winnings are taxable, see

then add your taxes together. See

Social Security benefits, VA benefits,

instructions for Line 20, Page 15.

7.

instructions for Married Filing Sepa-

Workers’ Compensation, Unemploy-

rately on the Same Return, Box 4.

ment Compensation, Railroad Retire-

ment benefits and related supple-

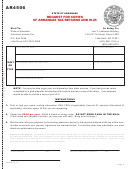

FILING AN AMENDED RETURN

If you use Method A, your result will be either a COM-

mental benefits are exempt from tax.

BINED REFUND or a COMBINED TAX DUE.

If filing an amended return, check the box at

The rental value of a home or the

8.

METHOD B.

File separate individual tax returns.

the top right corner of Form AR1000F/ AR1000NR/

housing allowance paid to a duly

See instructions for Married Filing

AR1000S. Complete the return, replacing the

ordained or licensed minister of a

Separately on Different Returns,

incorrect entries from your original return with the

recognized church is exempt to the

Box 5.

amended entries. Attach an explanation

extent that it was used to rent or

and supporting documentation for items

If you use Method B, one of you may owe tax and

provide a home. The rental value of a

changed. (Do not file an amended return

the other may get a refund. The tax due must be

home furnished to a minister includes utilities

until after your original return has been

paid with the proper tax return and the refund will be

furnished to the minister as part of compensa-

processed.)

due on the other return. YOU MAY NOT OFFSET

tion. The housing allowance paid to a minister

ONE AGAINST THE OTHER.

includes an allowance for utilities paid to the

Amended return needed:

minister as part of compensation to the extent

•

to make changes or adjustments to your

it was used to furnish utilities in the home.

original return

BOX 3. Filing Status 3 (Head of House-

•

if the IRS examines your federal return for any

hold)

Disability income MAY BE exempt from

9.

tax year and changes your net taxable income

tax pursuant to Internal Revenue Code

(required to file an Arkansas amended return

To file as Head of Household you must have been

§104.

within 90 days of IRS notification)

unmarried or legally separated on December 31,

2013 and meet either 1 or 2 below. The term

10. The first $9,000 of U.S. Military Com-

Amended return not needed:

“Unmarried” includes certain married persons who

pensation is exempt from tax.

to correct an address (You must provide

•

lived apart, as discussed at the end of this section.

a completed Individual Income Tax Account

11. If you received income from an em-

Change Form located on Page 8.)

1.

You paid over half the cost of keeping a home

ployer sponsored retirement plan,

to correct a Social Security Number

•

for the entire year that was the main home of

including disability retirement, that

(Call (501) 682-1100 or write to Individual

your parent whom you can claim as a depen-

is not exempt under IRC §104, the

Income Tax Section, P.O. Box 3628, Little

dent. Your parent did not have to live with you

first $6,000 is exempt from tax. For

Rock, AR 72203. You may be asked to provide

in your home.

tax years 2003 and later, if you contrib-

documentation.)

uted after-tax dollars to your plan, you are

•

if you are notified by the Income Tax Section

OR

allowed to recover your cost (investment)

that there is an error on your original return

in your retirement plan in accordance with

•

if filing a federal amended return with no

2.

You paid over half the cost of keeping a

Internal Revenue Code §72. Then the first

impact on your Arkansas income tax return

home in which you lived, and in which one

$6,000 of the balance is exempt from tax. (If

of the following also lived, for more than six

you received income from military retirement,

(6) months of the year (temporary absences,

you may adjust your figures if the payment

FILING STATUS

such as vacation or school, are counted as

included Survivor’s Benefit Payments. The

time lived in the home):

amount of adjustment must be listed on the

DETERMINE YOUR FILING STATUS

income statement, and supporting documen-

a. Your unmarried child, grandchild, great-

tation must be submitted with the return.)

grandchild, adopted child or stepchild.

This child did not have to be your depen-

12. If you received a traditional IRA dis-

BOX 1. Filing Status 1 (Single)

dent, but your foster child must have been

tribution after reaching the age of

your dependent.

fifty-nine and one-half (59 1/2), the

Check this box if you are SINGLE or UNMARRIED

first $6,000 is exempt from tax. Your

and DO NOT qualify as HEAD OF HOUSEHOLD.

b. Your married child, grandchild, adopted

traditional IRA distribution may be adjusted

(Read the instructions for BOX 3 to determine if you

child or stepchild. This child must have

for nondeductible IRA contributions, if any, by

qualify for HEAD OF HOUSEHOLD.)

been your dependent.

completing Federal Form 8606 and attach-

ing it to your Arkansas return. Premature dis-

c. Any other person whom you could claim

BOX 2. Filing Status 2 (Married Filing

tributions made on account of the participant’s

as a dependent.

Joint)

death or disability also qualify for the exemp-

tion. All other premature distributions

MARRIED PERSONS WHO LIVED APART

or early withdrawals including, but

Check this box if you were MARRIED and are filing

not limited to, those taken for medical

jointly. IF YOU ARE FILING A JOINT RETURN,

Even if you were not divorced or legally separated

expenses, higher education expenses

YOU MUST ADD BOTH SPOUSES’ INCOME

in 2013, you may be considered unmarried and

or a first-time home purchase do not

TOGETHER. Enter the total amount in column A on

file as Head of Household. See Internal Revenue

qualify for the exemption.

Lines 8 through 20 under “Your/Joint Income”.

Service instructions for Head of Household to

determine if you qualify.

MARRIED COUPLES

CHOOSING THE

A surviving spouse qualifies for the exemption;

BEST FILING STATUS

however he/she is limited to a single $6,000 ex-

emption.

If you and your spouse had separate incomes, you

NOTE:

The total exemptions from all plans

might save money by figuring your tax separately

described under 11 and 12 cannot

using one of the following two methods. Use the

exceed $6,000 per taxpayer, not

method that suits you best.

including recovery of cost.

Page 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25