Arkansas Individual Income Tax Forms And Instructions - 2013 Page 6

ADVERTISEMENT

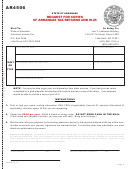

SPECIAL INFORMATION FOR 2013

FEDERAL TAX PROVISIONS MAY AFFECT YOUR 2012 ARKANSAS TAX RETURN

The State of Arkansas retroactively adopted IRC §163 and §408, part of the American Taxpayer Relief Act

of 2012. For tax year 2012 these sections allow for a deduction of mortgage insurance premiums (PMI) and

tax free distributions from an IRA for charitable purposes. Taxpayers who have already filed 2012 returns but

qualify to claim either or both of these tax provisions may amend their returns using Form AR1000F (full year

resident) or AR1000NR (part year resident or nonresident).

Taxpayers claiming a deduction for PMI should report the amount on Line 26 of the itemized deduction schedule,

Form AR3. Tax free distributions from an IRA for charitable purposes should be reported on Line 51 of Form

AR1000F or AR1000NR. Income tax forms are available at or by calling the

Individual Income Tax Section at (501) 682-1100 or (800) 882-9275.

Amended Returns

Taxpayers amending their original returns should simply check the “AMENDED RETURN” box on Form AR1000F, AR1000NR,

or AR1000S, and then complete the return using their corrected information. No separate amended return form is

necessary. See page

12

for instructions. (For tax years 2009 and prior, amended forms are available at

gov/incometax.)

Vouchers

All payments must be accompanied by an appropriate payment voucher, including payments made with returns.

Failure to send a voucher with a payment will cause delayed processing of the payment, which could

result in a billing notice being sent. See line 50C on Form AR1000F or AR1000NR and page 17 for instructions.

Arkansas Taxpayer Access Point (ATAP)

ATAP allows taxpayers or their representatives to log on to a secure site and manage all of their tax accounts online. ATAP al-

lows taxpayers to make name and address changes, view letters on their accounts, make payments and check refund status.

(Registration with ATAP is not required to make payments or check refund status.) Go to for

more information.

New Set Offs Added

Act 158 of 2013 authorizes a set off against an Arkansas income tax refund for a debt owed to the Arkansas Real

Estate Commission. Effective August 15, 2013.

Act 961 of 2013 authorizes a set off against an Arkansas income tax refund for a debt owed to the Arkansas Public

Defender Commission. Effective August 15, 2013.

Income Tax Technical Corrections Act (Act 1254 of 2013)

IRC §163 as in effect on January 1, 2012 regarding deduction of qualified mortgage insurance premiums as interest expense.

IRC §179 as in effect on January 1, 2009 regarding depreciation dollar limits and phase out thresholds.

IRC §170 as in effect on January 1, 2012 regarding deduction of charitable contributions.

IRC §221 as in effect on January 1, 2013 regarding deduction of interest paid on qualified education loans.

Page 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25