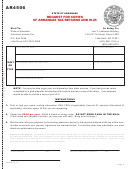

Arkansas Individual Income Tax Forms And Instructions - 2013 Page 16

ADVERTISEMENT

PRORATION

LINE 30. Taxpayers subject to additional tax on

CAUTION:

You WILL NOT receive credit for

their federal return from a traditional IRA or em-

tax withheld or receive a tax refund,

ployer qualified retirement plan are subject to ad-

unless you attach CORRECT AND

IF FILING A FULL YEAR RESIDENT RE-

ditional tax on their state return. Enter ten percent

LEGIBLE W-2(s) or other approved

TURN, go to instructions for Line 37. The

(10%) of the federal amount from Part I of federal

documentation to your tax return.

instructions for Line 36A through Line

Form 5329. Be sure to enter total distribution(s)

36D apply only to nonresidents and part

DO NOT include FICA, federal income tax, tax paid

from Part I, Form 5329, on Line 16 or 17 of Form

year residents.

to another state or 3% tax withheld from winnings

AR1000F/AR1000NR.

on electronic games of skill.

Gambling winnings

from Arkansas electronic games of skill are not

NONRESIDENTS AND PART YEAR RESI-

Taxpayers subject to additional tax on a distribu-

included as income and the 3% tax withheld is

DENTS ONLY, read the following instructions

tion from a Coverdell Education Savings Account,

excluded from Line 37.

to determine your correct Arkansas tax liability.

include ten percent (10%) of the federal amount

Attach a complete copy of your federal

from Part II of federal Form 5329 on this line. Be

DO NOT correct a W-2 yourself. Your em-

return.

sure to include the taxable amount of the Coverdell

ployer must issue you a corrected W-2.

Education Savings Account distribution on Line

20 of Form AR1000F/AR1000NR (Other Income).

LINE 36A. Enter adjusted gross income from

LINE 38. If you made an estimated declaration

Line 23, Column C.

LINE 31. Add Lines 28 through 30 and enter

and paid estimated tax payments on 2013 income

the total.

OTHER THAN wages, salaries, tips, etc., write the

LINE 36B. Enter total of Columns A and B from

total paid in this space. The only amount to enter

Line 23.

here is total payments you made on a 2013 Decla-

ration of Estimated Income Tax (includes January

15, 2014 installment and/or credit brought forward

TAX CREDITS

from 2012 tax return).

LINE 36C. Divide amount on Line 36A by amount

on Line 36B to arrive at your Arkansas percentage

LINE 32. Enter the total personal tax credits

DO NOT include PENALTIES OR INTEREST as

of income. Enter percentage as a decimal rounded

from Line 7D.

part of the amount paid.

to six places.

Example: $2,500/$525,000 = 0.004762

If you and your spouse filed a JOINT dec-

LINE 33. The Child Care Credit allowed is

or

laration and you and your spouse choose

twenty percent (20%) of the amount allowed on

$10,000/$60,000 = 0.166667

to file your tax returns on separate forms

your federal return. A copy of federal Form

this year, payments made under the joint

2441, “Credit for Child and Dependent

declaration of estimate will be credited

Care Expenses” must be attached to

LINE 36D. Multiply amount on Line 36 by decimal

to the primary filer.

your Arkansas return. (If this credit is

on Line 36C for Arkansas apportioned tax liability.

for Approved Early Childhood Credit, see

If you are filing prior year tax returns past

instructions for Line 41.)

the due date of the tax return, the refund/

overpayment from those tax returns can-

PAYMENTS

not be carried forward as estimated tax.

LINE 34. Complete Form AR1000TC if you are

eligible for any credit(s) listed below and include the

LINE 37. Enter Arkansas tax withheld from your

total on this line. Attach Form AR1000TC.

LINE 39. If you filed an Arkansas extension

W-2(s)/1099-R(s). You have already paid this

request and paid tax with your request, enter the

amount of tax during the year. If you have MORE

State Political Contribution Credit

amount paid.

THAN ONE W-2/1099-R, be sure to add the Arkan-

Other State Tax Credit

sas income tax withheld from all W-2(s)/1099-R(s).

Credit for Adoption Expenses

Enter the total withheld.

Phenylketonuria Disorder Credit

LINE 40. PREVIOUS PAYMENTS:

This line

Business Incentive Tax Credit(s)

is for amended returns only.

Enter the total of any

IF YOU AND YOUR SPOUSE ARE FILING ON THE

previous payment(s) made with your original return

SAME RETURN, add the Arkansas state income

and/or billing notices and amended return(s).

tax withheld from all your W-2(s)/1099-R(s). Enter

LINE 35. Add Lines 32 through 34 and enter

the combined total withheld.

the total.

LINE 41. Enter the APPROVED early childhood

If you did not receive (or lost) your

credit (20% of the federal child care credit). This

W-2(s) and Arkansas tax was withheld from

LINE 36. Subtract Line 35 from Line 31. This is

is for individuals with a dependent child placed

your Net Tax. If Line 35 is greater than Line 31,

your income, you should take the following

in an APPROVED child care facility while the

steps IN THE ORDER LISTED BELOW:

enter zero (0).

parent or guardian worked or pursued employ-

ment. (Facility must be approved by the Arkansas

1) Ask your employer for copies of your

NOTE:

If your net tax is $1,000 or more,

Department of Education as having an appropriate

and you failed to make a declaration of

W-2(s). If you cannot obtain them from

early childhood program as defined by Arkansas

Estimated Tax (Form AR1000ES, Voucher

your employer you should

law.) Enter the certification number and

2) Contact the Social Security

1), or pay withholding equal to 90% of

attach federal Form 2441 and Certifica-

Administration at (800) 772-1213.

your net tax, a penalty of ten percent

tion Form AR1000EC.

Contact your child

Only if you cannot obtain your W-2(s) from

(10%) will be assessed. See instructions for

care facility for Form AR1000EC.

your employer or SSA you may

Lines 50A and 50B for more information.

3) Complete federal Form 4852 and

attach a copy of your final pay stub to

LINE 42. Add the amounts on Lines 37,38,39,40

support your amounts.

and 41. This is your TOTAL PAYMENTS.

Page 16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25