Arkansas Individual Income Tax Forms And Instructions - 2013 Page 22

ADVERTISEMENT

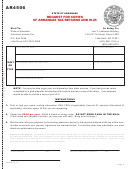

SELF-EMPLOYED HEALTH INSURANCE DEDUCTION WORKSHEET

1.

Enter the amount you paid in 2013 for health insurance for you, your spouse, and your dependents. ............. 1 ______________

2.

Enter your net profit and any other earned income* from the business under which the

insurance plan was established, less any deductions on Form AR1000ADJ, Line 10. .............................. 2 ______________

Enter the smaller of Line 1 or Line 2 here and on Form AR1000ADJ, Line 9.

3.

(Do not include this amount in figuring your medical expense deduction on the Itemized Deduction Schedule.) ... 3 ______________

* Earned income includes net earnings and gains from the sale, transfer, or licensing of property you created. It does not include

capital gain income. If you were more than a 2% shareholder in an S corporation, earned income is your wages from that

corporation.

MILEAGE AND DEPLETION ALLOWANCES

Mileage Allowance

Business..................................... 56.5 cents/mile

Charitable ...................................... 14 cents/mile

Medical/Moving ............................. 24 cents/mile

Mail Carrier (rural) ...... Reimbursement received

Depletion Allowance

Depletion (gas and oil) ....................................... Same as federal

(15% for most gas and oil production)

DEPRECIATION INFORMATION

Section 179 Facts

Arkansas adopted IRC §179 as in effect on January 1, 2009, allowing greater dollar limits

and phase out thresholds.

Deduction Limit

$25,000

Cost of qualifying property limit

$200,000

No deduction allowed above $225,000

More than one property placed in service

limit $25,000 deduction per

taxpayer per year

Any cost not deducted in one year may be carried forward to next year

Deduction may not be used to reduce taxable income below zero

Note: Arkansas has not yet adopted the most recent federal changes.

Page 22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25