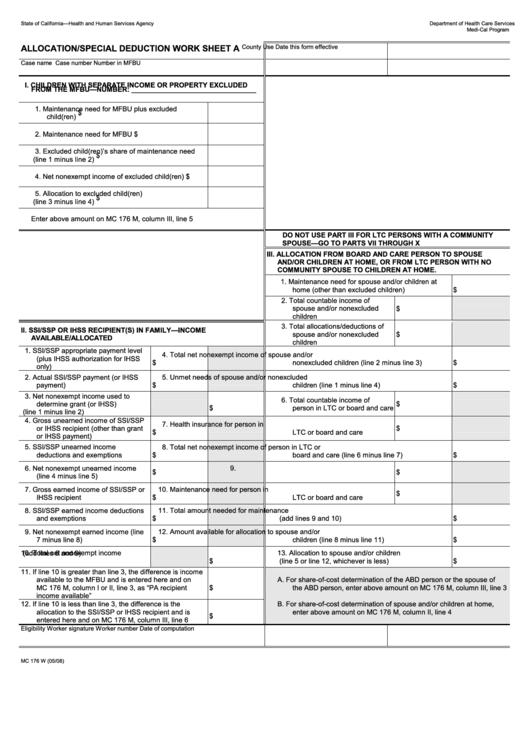

Form Mc 176 W - Allocation/special Deduction Work Sheet A

ADVERTISEMENT

Department of Health Care Services

State of California—Health and Human Services Agency

Medi-Cal Program

ALLOCATION/SPECIAL DEDUCTION WORK SHEET A

County Use

Date this form effective

Case name

Case number

Number in MFBU

I. CHILDREN WITH SEPARATE INCOME OR PROPERTY EXCLUDED

FROM THE MFBU—NUMBER: ________________________________

1. Maintenance need for MFBU plus excluded

$

child(ren)

2. Maintenance need for MFBU

$

3. Excluded child(ren)’s share of maintenance need

$

(line 1 minus line 2)

4. Net nonexempt income of excluded child(ren)

$

5. Allocation to excluded child(ren)

$

(line 3 minus line 4)

Enter above amount on MC 176 M, column III, line 5

DO NOT USE PART III FOR LTC PERSONS WITH A COMMUNITY

SPOUSE—GO TO PARTS VII THROUGH X

III. ALLOCATION FROM BOARD AND CARE PERSON TO SPOUSE

AND/OR CHILDREN AT HOME, OR FROM LTC PERSON WITH NO

COMMUNITY SPOUSE TO CHILDREN AT HOME.

1. Maintenance need for spouse and/or children at

home (other than excluded children)

$

2. Total countable income of

spouse and/or nonexcluded

$

children

3. Total allocations/deductions of

II. SSI/SSP OR IHSS RECIPIENT(S) IN FAMILY—INCOME

spouse and/or nonexcluded

AVAILABLE/ALLOCATED

$

children

1. SSI/SSP appropriate payment level

4. Total net nonexempt income of spouse and/or

(plus IHSS authorization for IHSS

$

nonexcluded children (line 2 minus line 3)

$

only)

2. Actual SSI/SSP payment (or IHSS

5. Unmet needs of spouse and/or nonexcluded

children (line 1 minus line 4)

payment)

$

$

3. Net nonexempt income used to

6. Total countable income of

determine grant (or IHSS)

$

person in LTC or board and care $

(line 1 minus line 2)

4. Gross unearned income of SSI/SSP

7. Health insurance for person in

or IHSS recipient (other than grant

$

LTC or board and care

$

or IHSS payment)

5. SSI/SSP unearned income

8. Total net nonexempt income of person in LTC or

deductions and exemptions

$

board and care (line 6 minus line 7)

$

6. Net nonexempt unearned income

9.

(line 4 minus line 5)

$

$

7. Gross earned income of SSI/SSP or

10. Maintenance need for person in

IHSS recipient

$

LTC or board and care

$

8. SSI/SSP earned income deductions

11. Total amount needed for maintenance

and exemptions

$

(add lines 9 and 10)

$

9. Net nonexempt earned income (line

12. Amount available for allocation to spouse and/or

7 minus line 8)

$

children (line 8 minus line 11)

$

10. Total net nonexempt income

13. Allocation to spouse and/or children

(add lines 6 and 9)

$

(line 5 or line 12, whichever is less)

$

11. If line 10 is greater than line 3, the difference is income

available to the MFBU and is entered here and on

A.

For share-of-cost determination of the ABD person or the spouse of

MC 176 M, column I or II, line 3, as “PA recipient

$

the ABD person, enter above amount on MC 176 M, column III, line 3

income available”

12. If line 10 is less than line 3, the difference is the

B.

For share-of-cost determination of spouse and/or children at home,

allocation to the SSI/SSP or IHSS recipient and is

enter above amount on MC 176 M, column II, line 4

$

entered here and on MC 176 M, column III, line 6

Eligibility Worker signature

Worker number

Date of computation

MC 176 W (05/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4