Commercial And Industrial/manufacturing Expansion Programs - Application And Instructions - New York City Department Of Finance Page 8

ADVERTISEMENT

Page E

Commercial and Industrial Manufacturing Expansion Program Definitions

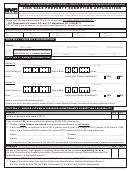

COMMERCIAL AND INDUSTRIAL/MANUFACTURING EXPANSION PROGRAM

DEFINITIONS

The purpose of these definitions is to serve as a broad explanation to help applicants complete the application. These definitions are not in-

tended to serve as legal definitions. For legal definitions, refer to the relevant statutes and/or promulgated rules.

Abatement Zone - Any area that is zoned C4, C5, C6, M1, M2 or M3 in accordance with New York City zoning laws, that is located in Man-

hattan north of the center line of 96th Street or in the boroughs of The Bronx, Brooklyn, Queens or Staten Island. For industrial or manufac-

turing tenants only, with leases commencing on or after July 1, 2005, the abatement zone will also include the Special Garment Center District

in Manhattan as designated by Article XII, Chapter 1 of the Zoning Resolution of the City of New York: West 35th Street to West 38th Street

from Broadway to 7th Avenue; West 35th Street to West 40th Street from 7th Avenue to 8th Avenue; West 35th Street to West 39th Street from

8th Avenue to 100 feet East of 9th Avenue; The northerly half of the block bounded by West 34th Street, West 35th Street, 7th Avenue and

8th Avenue.

Applicant - If filing for tax abatement benefits-the tenant and landlord.

Eligible Building - A non-residential or mixed use building that is located in the abatement zone which was legally occupiable prior to Janu-

ary 1, 1999. The building must also have a total floor area of at least 25,000 square feet. Government owned buildings are not eligible for ben-

efits pursuant to this program. Individual condominium units in eligible buildings are considered separate eligible buildings. The minimum

building size and age requirements are no longer applicable to industrial and manufacturing tenants with leases that commence on or after

July 1, 2005 and are otherwise eligible for the enhanced abatement schedule.

Eligible Premises - In general, premises located in an eligible building that are occupied or used as offices or commercial (excluding hotel

and retail) and manufacturing activities. For manufacturing and industrial tenants with leases commencing on or after July 1, 2005, “eligible

premises” must be occupied or used for industrial and manufacturing activities as defined below.

Eligibility Period - For office and general commercial tenants the eligibility period is July 1, 2000 to June 30, 2018. For industrial and manu-

facturing tenants with leases commencing on or after July 1, 2005 the eligibility period is July 1, 2005 to June 30, 2018. In order for the lease

to be eligible, the lease commencement date must be within the applicable period.

Industrial and Manufacturing Activities - Activities involving the assembly of goods to create a different article, or the processing, fabrica-

tion, or packaging of goods.

Lease Type

New lease - A lease:

a) With a tenant who is relocating or expanding to eligible premises:

1) from a relocation area; or

2) from an eligible building whose lease will expire during the eligibility period; or

3) from a premises in the abatement zone which is not an eligible building; or

4) from a building in the abatement zone that the tenant owns; or

b) With a tenant who does not occupy any premises immediately prior to executing a lease for eligible premises;

Renewal Lease - A lease executed during the eligibility period for the continued use of all or part of a premises in an eligible building, or all

or part of such premises and additional premises in such eligible building which had been leased by the same lessor under a lease expir-

ing during the eligibility period.

Expansion Lease - A lease executed for an eligible (expansion) premises where the lessor already occupies premises in an eligible build-

ing under a lease that will not expire during the eligibility period.

Mixed Use Building - A building used for both residential and commercial purposes with more than twenty five per cent of the building being

used for commercial, community facility or accessory purposes.

Subtenant - An entity whose right to occupy and use the eligible premises is not derived from a lease with the landlord. In those instances,

where a tenant subleases to another entity (a subtenant), both parties are not eligible for abatement benefits for the subleased space. For

purposes of this program, any ancillary term used to reflect a tenant/subtenant relationship (e.g., licensee or use agreement, etc.) is ineligible

for benefits for such space.

Tenant - Any entity (including any successors in interest) who executes a lease with the landlord for the right to occupy or use the eligible prem-

ises and does so as per the lease agreement.

Tenant’s Percentage Share - The percentage of a building’s aggregate floor area allocated to the eligible premises. In the case of an expansion

tenant, the share should be calculated as the percentage of the building’s floor area allocated solely to the expansion premises. This figure

must be listed in the lease and lease abstract.

Total Floor Area - The sum of the gross area of a building measured from the exterior walls.

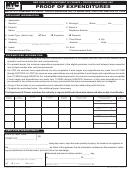

Work Letter - A specific and detailed description of the improvements made or contemplated for the eligible premises. Please detail by major

trade or category the estimated or actual cost of such improvements.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10