Commercial And Industrial/manufacturing Expansion Programs - Application And Instructions - New York City Department Of Finance Page 3

ADVERTISEMENT

Page 3

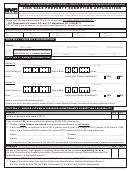

Commercial and Industrial/Manufacturing Expansion Programs Application

AGREEMENTS AND REPRESENTATIONS

The undersigned agree and represent that:

1. S/he has authority to make this application on behalf of the ten-

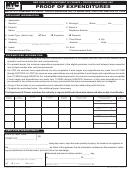

10. The lease for the eligible premises contains the following provi-

ant/applicant or owner/applicant.

sions. A statement in at least twelve point type:

2. S/he has personal knowledge or information sufficient to make a

a) of the tenant’s percentage share;

materially correct response to the questions asked in this applica-

b) informing the tenant that:

tion form, and that s/he knows or believes all matters stated herein

1) an application for abatement of real property taxes will be

to be true.

made for the premises;

3. The applicant and its employees and agents will comply with all

2) the rent including amounts payable by the tenant for real

provisions of law and rules relating to the program.

property taxes will accurately reflect any abatement of real

4. The applicant has paid the application fee and will pay all other fees

property taxes;

and penalties payable under the rules promulgated by the Depart-

3) (i) for commercial tenants with leases commencing on or after

ment of Finance.

July 1, 2000: at least $2.50 per square foot or $25 per square

5. The applicant will comply with all applicable provisions of law and rules

foot in the abatement zone must be spent on improvements

relating to the construction, maintenance and operation of buildings.

to the premises and the common areas, the amount being

6. The Department of Finance may deny, reduce, suspend, revoke,

dependent upon the length of the lease and whether it is a

or terminate any benefits under this program, if the recipient:

new, renewal or expansion lease.

a) fails to comply with the requirements of this program, or

(ii) for industrial and manufacturing tenants with leases com-

mencing on or after July 1, 2005: the required expendi-

b) knowingly misstates or omits information in the application, or

ture amounts of at least $2.50 per square foot in the

c) is discovered to have building, fire or air pollution control code

abatement zone must be spent on improvements to the

violations on the subject property.

premises and the common areas for new or expansion

7. The applicant(s) will submit to the jurisdiction of the Department over any

leases. A renewal lease for space previously occupied by

determination of eligibility or noncompliance under the program and will

the same tenant will require a minimum expenditure of $5

submit any claim under the program to administrative review as pro-

per square foot; when a renewal lease includes additional

vided in the rules before seeking any other remedy.

space not previously occupied, the minimum expenditure

for that additional space is $2.50 per square foot.

8. Within seven years immediately preceding the application, neither the

applicants nor any person having a substantial interest in the eligible

4)

all abatements granted will be revoked if, during the benefit period,

premises, nor any officer, director, or general partner, or such person

real estate taxes, water or sewer charges or other lienable charges

was finally adjudicated by a court of competent jurisdiction to be guilty

are unpaid for more than one year, unless such delinquent

of arson, or was an officer, director or general partner of any such en-

amounts are paid as provided in the relevant law.

tity at the time such person was finally adjudicated to have violated the

11. The lease for the eligible premises does not provide an option to

law.

terminate the lease prior to the initial lease term except as pro-

9. If any charges are pending alleging violation of arson law in any ju-

vided for in the applicable law.

risdiction against the applicants, any person having a substantial in-

terest in the premises, or any officer, director, general partner, or

such person, the applicant will set forth such charges in a state-

ment attached to these agreements.

-

A F F I D A V I T

-

STATE OF NEW YORK

SS:

COUNTY OF

___________

__________________________________________________, being duly sworn, says under penalty of perjury that

he/she is the owner/applicant or the ___________________________________ of the owner/applicant(s), that the statements con-

tained in this application, including any attachments to this application, are true to his/her knowledge.

Signature of OWNER OR REPRESENTATIVE

Subscribed and sworn to before me this

Affix

_____________day of__________________ 20________

official stamp or

seal here.

_______________________________________________

Signed by Notary Public

-

A F F I D A V I T

-

STATE OF NEW YORK

SS:

COUNTY OF

___________

__________________________________________________, being duly sworn, says under penalty of perjury that

he/she is the tenant/applicant or the ___________________________________ of the tenant/applicant(s), that the statements con-

tained in this application, including any attachments to this application, are true to his/her knowledge.

Signature of TENANT OR REPRESENTATIVE

Subscribed and sworn to before me this

Affix

_____________day of__________________ 20________

official stamp or

seal here.

_______________________________________________

Signed by Notary Public

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10