Form Nyc-2a - Combined Business Corporation Tax Return - 2017 Page 10

ADVERTISEMENT

:

:

_________________________________

______________________

NAME OF DESIGNATED AGENT

EIN

Form NYC-2A - 2017

Page 10

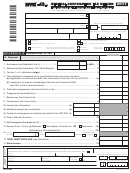

SCHEDULE H - Determination of Tax Rate

%

A.

Enter the tax rate computed or used below (see instructions) ............................................................................A.

B.

Enter the line number of the tax rate computed or used below...........................................................................B.

Ca. Enter your combined unallocated business income from Schedule B, line 30 (see instructions) .....................Ca.

Cb. If the amount on line Ca is not correct, enter correct amount here and explain in rider (see instructions) ......Cb.

D.

Enter your combined allocated business income from Schedule B, line 32a or 32b if used...............................D.

n

E.

If you are a Qualified Manufacturing Corporation mark an X in the box (see instructions) .................................E.

Tax Rate Computation For Business Corporations Not Specified Below ( see instructions)

1.

If combined unallocated business income (Schedule B, line 30) is less than $2M and allo-

6.50%

cated combined business income (Schedule B, line 32a or 32b if used) is less than $1M.

2.

If combined unallocated business income (Schedule B, line 30) is equal to or greater

8.85%

than $3M (regardless of the amount of combined allocated business income)

3.

If combined allocated business income (Schedule B, line 32a or 32b if used) is equal to or

8.85%

greater than $1.5M (regardless of the amount of combined unallocated business income)

4.

If combined unallocated business income (Schedule B, line 30) is equal to or greater

%

line 30 - 2,000,000

6.50% + (2.35% X

) =

than $2M but less than $3M and combined allocated business income (Schedule B,

1,000,000

line 32a or 32b if used) is less than $1M, use unallocated formula

5.

If combined unallocated business income (Schedule B, line 30) is less than $2M and

%

line 32a or 32b - 1,000,000

combined allocated business income (Schedule B, line 32a or 32b if used) is equal

6.50% + (2.35% X

) =

500,000

to or greater than $1M but less than $1.5M, use allocated formula

%

line 30 - 2,000,000

6.50% + (2.35% X

) =

1,000,000

6.

If combined unallocated business income (Schedule B, line 30) is equal to or greater

than $2M but less than $3M and combined allocated business income (Schedule B,

%

line 32a or 32b - 1,000,000

line 32a or 32b if used) is equal to or greater than $1M but less than $1.5M, com-

6.50% + (2.35% X

) =

500,000

pute tax rates using both formulas. Use the greater of the two computed tax rates.

Enter the greater of the two computed tax rates: _________ %

Tax Rate Computation For Qualified Manufacturing Corporations (see instructions)

7.

If combined unallocated business income (Schedule B, line 30) is less than $20M and com-

4.425%

bined allocated business income (Schedule B, line 32a or 32b if used) is less than $10M

8.

If combined unallocated business income (Schedule B, line 30) is equal to or greater

8.85%

than $40M (regardless of the amount of combined allocated business income)

9.

If combined allocated business income (Schedule B, line 32a or 32b ikf used) is equal to or

8.85%

greater than $20M (regardless of the amount of combined unallocated business income)

10. If combined unallocated business income (Schedule B, line 30) is equal to or greater

%

line 30 - 20,000,000

4.425% + (4.425% X

) =

than $20M but less than $40M and combined allocated business income (Schedule B,

20,000,000

line 32a or 32b if used) is less than $10M, use unallocated formula

11. If combined unallocated business income (Schedule B, line 30) is less than $20M and

%

line 32a or 32b - 10,000,000

4.425% + (4.425% X

) =

combined allocated business income (Schedule B, line 32a or 32b if used) is equal to

10,000,000

or greater than $10M but less than $20M, use allocated formula

%

line 30 - 20,000,000

12. If combined unallocated business income (Schedule B, line 30) is

4.425% + (4.425% X

) =

20,000,000

equal to or greater than $20M but less than $40M and combined allo-

cated business income (Schedule B, line 32a or 32b if used) is equal

%

to or greater than $10M but less than $20M, compute tax rates using

line 32a or 32b - 10,000,000

4.425% + (4.425% X

) =

both formulas. Use the greater of the two computed tax rates

10,000,000

Enter the greater of the two computed tax rates: _________ %

Tax Rate Computation For Certain Financial Corporations ( see instructions )

13. Financial Corporations as defined in Administrative Code

9.00%

Section 11-654(1)(e)(1)(i)

320101791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10