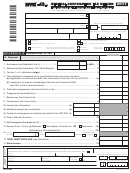

Form Nyc-2a - Combined Business Corporation Tax Return - 2017 Page 8

ADVERTISEMENT

:

:

_________________________________

_______________________

NAME OF DESIGNATED AGENT

EIN

Form NYC-2A - 2017

Page 8

SCHEDULE F - Computation of Combined Business Allocation Percentage

E

A

B

C

D

Combined group

Designated

Total of all

Intercorporate

Combined group

Everywhere total

Agent

affiliates

eliminations

NYC total (A + B - C)

(A + B - C)

1a.

Real estate owned

1a(A). New York City.....................................

1a(B). Everywhere ........................................

Real estate rented - multiply by 8 (see instructions) (attach rider)

1b.

1b(A). New York City.....................................

1b(B). Everywhere ........................................

1c.

Inventories owned

1c(A). New York City.....................................

1c(B). Everywhere ........................................

1d.

Tangible personal property owned (see instructions)

1d(A). New York City.....................................

1d(B). Everywhere ........................................

1e.

Tangible personal property rented - multiply by 8 (see instr., attach rider)

1e(A). New York City.....................................

1e(B). Everywhere ........................................

1f(A).

Total Property New York City (add column D, lines 1a(A) through 1e(A)) .................................................

1f(B).

Total Property Everywhere (add column E, lines 1a(B) through 1e(B))........................................................................................

1g.

Percentage in New York City (divide line 1f(A), column D by line 1f(B), column E).....................................................................

%

1h.

Multiply line 1g by 3.5 ...................................................................................................................................................................

2a(A). New York City receipts (from Form NYC-2.5A, line 54, column D) ...........................................................

2a(B). Everywhere receipts (from From NYC-2.5A, line 54, column E) ..................................................................................................

%

2b.

Percentage in New York City (divide line 2a(A), column D by line 2a(B), column E) .............................................................................

2c.

Multiply line 2b by 93 ....................................................................................................................................................................

3.

Wages, salaries and other compensation of employees, except general executive officers (see instructions)

3a(A). New York City.....................................

3a(B). Everywhere ........................................

%

3b.

Percentage in New York City (divide line 3a(A), column D by line 3a(B), column E).........................................................................

3c.

Multiply line 3b by 3.5 ...................................................................................................................................................................

Sum of Weighted Factors

4.

Add lines 1h, 2c and 3c.................................................................................................................................................................

Business Allocation Percentage

5.

Divide line 4 by 100 if no factors are missing. If a factor is missing, divide line 4 by the total weights of

the factors present. Enter as a percentage. Round to the nearest one hundredth of a percentage point.

%

This is your business allocation percentage.

32081791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10