Form Nyc-2a - Combined Business Corporation Tax Return - 2017 Page 3

ADVERTISEMENT

:

:

_________________________________

_______________________

NAME OF DESIGNATED AGENT

EIN

Form NYC-2A - 2017

Page 3

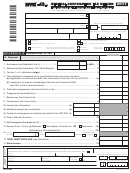

SCHEDULE B - Computation of Tax on Combined Business Income Base

DESIGNATED

TOTAL OF ALL

INTERCORPORATE

COMBINED

AFFILIATES

ELIMINATIONS

GROUP TOTAL

AGENT

1a.

Federal consolidated taxable income (CTI) of New York City combined group (see instructions) .......................................... 1a. _________________

1b.

Addback federal consolidated net operating loss deduction (NOLD) ...................................................................................... 1b. _________________

1c.

Addback federal consolidated dividends received deduction (DRD) ....................................................................................... 1c. _________________

1d.

Addback federal dividends paid deduction (DPD) of captive REITs and captive RICs disallowed by NYC ............................ 1d. _________________

1e.

Federal CTI before federal NOLD, federal DRD, and disallowed federal DPD (add lines 1a through 1d) .............................. 1e. _________________

1f.

Elimination of intercorporate dividends (see instructions)......................................................................................................... 1f. _________________

1g.

Federal CTI before New York City additions and subtractions (subtract line 1f from line 1e) ................................................. 1g. _________________

2.

Dividends and interest effectively connected with the

conduct of a trade or business in the United States NOT

included on line 1g by alien corporations ......................... 2. ____________________________________________________________________

3.

Any other income not included on line 1g which is exempt by

treaty from federal income tax but would otherwise be treated as

effectively connected with the conduct of a trade or business in

the United States by alien corporations .......................................3. ____________________________________________________________________

4.

Dividends not included on line 1g by non-alien corporations ....4. ____________________________________________________________________

5.

Interest on federal, state, municipal and other obligations not

included on line 1g by non-alien corporations ......................5. ____________________________________________________________________

6.

Income taxes paid to the US or its possessions deducted on federal return.....6. ____________________________________________________________________

7.

NYS Franchise Tax, including MTA taxes and other business taxes

deducted on the federal return (see instructions; attach rider)..............7. __________________________________________________________________________________________________

8.

NYC Corporate Taxes deducted on federal return (see instr.)....8. ____________________________________________________________________

9.

Adjustments relating to employment opportunity relocation

cost credit and IBZ credit ......................................................9. ____________________________________________________________________

10.

Adjustments relating to real estate tax escalation credit.....10. ____________________________________________________________________

11.

ACRS depreciation and/or adjustments (attach Form

NYC-399 and/or NYC-399Z) ...............................................11. ____________________________________________________________________

12.

Payment for use of intangibles ............................................12. ____________________________________________________________________

13.

Domestic production activities deduction (see instructions) ..13. ____________________________________________________________________

14.

Other additions (see instructions; attach rider) ...................14. ____________________________________________________________________

15.

Total lines 1g through 14 .....................................................15. ____________________________________________________________________

16.

Gain on sale of certain property acquired prior to 1/1/66 (see instr.)...16. ____________________________________________________________________

17.

NYC and NYS tax refunds included in line 15 (see instructions) 17. ____________________________________________________________________

18.

Wages and salaries subject to federal jobs credit

(see instructions) .................................................................18. ____________________________________________________________________

19.

Depreciation and/or adjustment calculated under pre-ACRS or

or pre - 9/11/01 rules (attach Form NYC-399 and/or

NYC-399Z; see instructions) ...............................................19. ____________________________________________________________________

20.

Other subtractions (see instructions) (attach rider) .............20. ____________________________________________________________________

21.

Total subtractions (add lines 16 through 20) .............................................................................................................................21. _________________

22.

Net modifications to federal taxable income (subtract line 21 from line 15) .............................................................................22. _________________

23.

Subtraction modification for qualified banks and other qualified lenders (from Form NYC-2.2, Schedule A, line 1; see instructions) .. 23. _________________

24.

Combined entire net income (ENI) (subtract line 23 from line 22) ........................................................................................... 24. _________________

25.

Investment and other exempt income (from Form NYC-2.1, Schedule D, line 1).................................................................... 25. _________________

26.

Entire net income less investment and other exempt income.................................................................................................. 26. _________________

27.

Excess interest deductions attributable to investment income and other exempt income (from Form NYC-2.1, Schedule D, line 2).... 27. _________________

28.

Combined Business income (add lines 26 and 27).................................................................................................................. 28. _________________

29.

Addback of income previously reported as investment income (from Form NYC-2.1, Schedule F, line 6; if zero or less, enter 0; see instr.)... 29. _________________

30.

Combined business income after addback (add lines 28 and 29) .......................................................................................................30. _________________

31.

Combined business allocation percentage (from Schedule F, line 5; if not allocating, enter 100%) ........................ 31. _________________

%

32a. Allocated combined business income after addback (multiply line 30 by line 31)...................................... 32a. _________________

32b. If the amount on line 32a is not correct, enter correct amount here and explain in rider (see instructions) .. 32b. _________________

33.

Prior net operating loss conversion subtraction (from Form NYC-2.3, Schedule C, line 4) ......................... 33. _________________

34.

Allocated business income less prior net operating loss conversion subtraction (see instructions) ............ 34. _________________

35.

Net operating loss deduction (from Form NYC-2.4, line 6) ........................................................................... 35. _________________

36.

Combined business income base (subtract line 35 from line 34)............................................................................ 36. _________________

%

37.

Tax rate (see instructions)............................................................................................................................. 37. _________________

38.

Tax on combined business income base (multiply line 36 by line 37

and enter here and on Schedule A, line 1)................................................................................................... 38. ____________________

32031791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10