Form Nyc-400b - Estimated Tax By Subchapter S Banking Corporations - 2018

ADVERTISEMENT

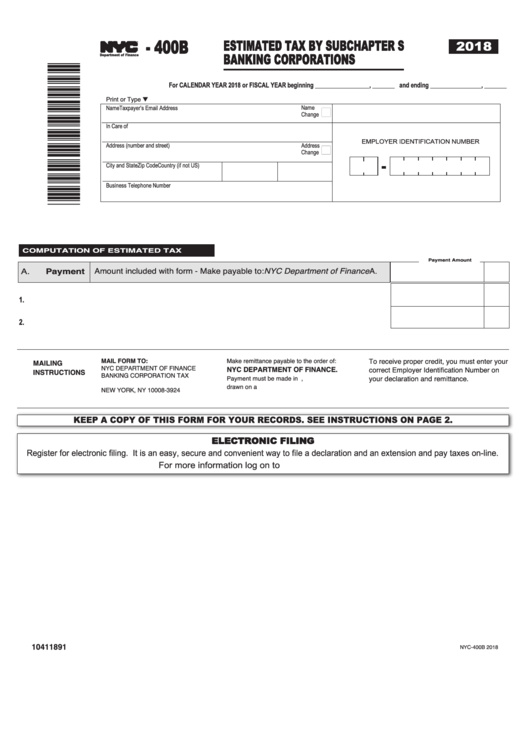

- 400B

ESTIMATED TAX BY SUBCHAPTER S

2018

BANKING CORPORATIONS

TM

Department of Finance

For CALENDAR YEAR 2018 or FISCAL YEAR beginning _________________, _______ and ending ________________, _______

Print or Type t

Name

Name

n

Taxpayer’s Email Address

Change

In Care of

EMPLOYER IDENTIFICATION NUMBER

n

Address (number and street)

Address

Change

City and State

Zip Code

Country (if not US)

Business Telephone Number

C O M P U TAT I O N O F E S T I M AT E D TA X

Payment Amount

Payment

Amount included with form - Make payable to: NYC Department of Finance...... A.

A.

1. Declaration of estimated tax for current year........................................................................

1.

2. Estimated Payment Amount .................................................................................................

2.

To receive proper credit, you must enter your

MAIL FORM TO:

MAILING

Make remittance payable to the order of:

NYC DEPARTMENT OF FINANCE.

NYC DEPARTMENT OF FINANCE

correct Employer Identification Number on

INSTRUCTIONS

BANKING CORPORATION TAX

your declaration and remittance.

Payment must be made in U.S. dollars,

P.O. BOX 3924

drawn on a U.S. bank.

NEW YORK, NY 10008-3924

KEEP A COPY OF THIS FORM FOR YOUR RECORDS. SEE INSTRUCTIONS ON PAGE 2.

ELECTRONIC FILING

Register for electronic filing. It is an easy, secure and convenient way to file a declaration and an extension and pay taxes on-line.

For more information log on to NYC gov/eservices

10411891

NYC-400B 2018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2