Pass-Through Entity Owner Payments And Oregon Affidavit - 2015 Page 2

ADVERTISEMENT

An affidavit should be updated if there is a change in the

percent), and the tax paid to Oregon on his behalf ($1,484)

entity information or if the ownership percentage of an

which will also match the Form OR-19 annual report ACME

owner that has filed an affidavit changes by 10 percent or

submitted.

more. The owner does not need to send an updated affidavit

On his Oregon return in the federal column, Charlie will

solely for address changes. Addresses are updated when

report his income of $142,000 from federal Schedule E and

the owner files their tax return. If an affidavit is revoked or

$8,000 from federal Schedule D and deduction of $14,000. In

updated, be sure the correct address is on the form. When

the Oregon column, he will multiply those amounts by 10

sending us an updated affidavit or revocation, be sure to

percent ($14,200, $800, and $1,400). Since Oregon is discon-

send a copy to the entity as well.

nected from the domestic production activities deduction,

these same amounts ($14,000 in the federal column and

Oregon-source distributive income

$1,400 in the Oregon column) will also be added back in the

additions section of Charlie’s Oregon return.

For estimated tax purposes, distributive income is the net

amount of income, gain, deduction, or loss of a pass-through

Guaranteed payments

entity for the tax year. It includes items directly related to the

Guaranteed payments are treated as a business income

PTE that are considered in determining the federal taxable

component of the PTE’s distributive income and attributed

income of the nonresident owner. It also includes modifica-

tions provided in Oregon Revised Statute (ORS) Chapter 316

directly to the owner receiving the payment. See Oregon

and other Oregon laws that directly relate to the PTE.

Administrative Rule (OAR) 150-316.124(2).

Examples of the modifications allowed that relate to the

Deductions

PTE’s income include adjustments for depreciation, deple-

Individual tax deduction

tion, gain or loss difference on the sale of depreciable prop-

erty, and U.S. government interest. Modifications do not

Deductions normally allowed to individuals (itemized deduc-

include the federal tax subtraction, itemized deductions, and

tions or the standard deduction) are not allowed in determin-

the Oregon standard deduction.

ing the income amount upon which owner payments are

Oregon-source distributive income does not include return of

based and remitted.

capital, income sourced in another state, or other distributions

Self-employment tax deduction

not taxable by Oregon. Oregon-source distributive income is

the portion of the entity’s modified distributive income that

Each PTE must calculate the self-employment tax deduction

is derived from or connected with Oregon sources.

for each electing member that is subject to self-employment

If the PTE has business activity only in Oregon, multiply the

tax. The self-employment tax deduction that is attributable to

distributive income of the PTE by the ownership percentage

the Oregon-source distributive income is subtracted from the

of the nonresident owner.

Oregon-source distributive income to determine the amount

upon which the owner’s estimated payments are based.

Apportionable income

Credits

PTEs with business activity both inside and outside Oregon

during the year must calculate Oregon-source distributive

Credits normally allowed on owners’ tax returns, such as the

income for nonresident owners. Fill out Schedule AP-1 to

credit for income taxes paid to another state, are not taken into

figure the apportionment percentage. Fill out Schedule AP-2

account in determining the income amount upon which owner

using the PTE’s modified distributive income to apportion the

payments are based and remitted.

income between Oregon and other states. While most PTEs

don’t complete Schedule AP-2 for their own return, it can be

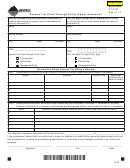

Form TPV-19 tax payment

useful for apportioning distributive income flowing through

to the owners.

instructions

Multiply line 11 on the Schedule AP-2 by the ownership

Calculate the amount of tax to be withheld and remitted to

percentage of each nonresident owner to get their share of

the department as follows:

Oregon-source distributive income to calculate their tax

payment.

• Individual owners: Use the highest individual tax rate on

the nonelecting owner’s share of Oregon-source distribu-

Example: Charlie, an Oregon nonresident, owns 20 percent

tive income. For 2015, the rate is 9.9 percent.

of ACME Partnership. For the year, the partnership had

$710,000 in ordinary income, $40,000 in capital gains, and

• C corporation owners: Use the corporate tax rates on the

$70,000 in domestic production activity deductions. ACME

nonelecting owner’s share of Oregon-source distributive

estimated Charlie’s Oregon source income for each period at

income. For 2015, the rate is 6.6 percent on the first $1 mil-

$3,750 and withheld $371 (9.9 percent). On Charlie’s Sched-

lion and 7.6 percent on the amount over $1 million.

ule K-1 and attachments, ACME reported his distributive

Once you calculate the total payment for the owners, enter

income, ACME’s Oregon apportionment percentage (10

the amount on voucher Form TPV-19. Enter the PTE’s infor-

150-101-182 (Rev. 12-14)

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6