Pass-Through Entity Owner Payments And Oregon Affidavit - 2015 Page 3

ADVERTISEMENT

mation on the voucher and submit it with the payment. You

address for each owner receiving a portion of the payment.

will reconcile how much of each payment goes to each owner

Incomplete forms will not be processed.

when you file the annual report at the end of the year.

Enter the date and amount of each payment sent in during

the tax year. Up to four payments can be reported on a Form

Due dates for tax payments

OR-19. Use whole dollars for all amounts. If the amounts in

any of the columns do not match the corresponding payment

Tax payments for the Oregon-source distributive income

that was made, the form will not be processed. Remember

of nonelecting owners must be remitted for the period in

that the owners will not receive credit for the payment made

which the distributive income is earned or estimated. Use

on their behalf until the PTE has submitted a correct Form

the entity’s tax year.

OR-19 annual report.

For calendar year entities, the due dates for 2015 are:

The Form OR-19 is due by the end of the second month after

• April 15, 2015 (1st period).

the end of the entity’s tax year. For tax year 2015, the due

• June 15, 2015 (2nd period).

date for entities using a calendar year is February 29, 2016.

• September 15, 2015 (3rd period).

Important: Provide each owner with their total payments in

• December 15, 2015 (4th period).

column (h) so they can claim the payment on their Oregon

For fiscal-year filing entities, the due dates are the 15th day

return when they file.

of the fourth, sixth, ninth, and 12th months of the tax year.

Use additional Form OR-19s as needed to divide a payment

Exception: Fiscal-year filing entities with only noncorporate

among all owners and enter the total for each column on the

owners who file using a calendar tax year may elect to use

last form. The total must match the payment as listed above

the due dates applicable to the owners instead. For example,

in the heading.

Beachside LLC has a 2014 fiscal tax year ending September

For example, Partnership ABC made only one payment of

30, 2015. The LLC would normally send in payments on

$3,500 during the year. They have 15 nonresident owners

the following due dates: January 15, 2015; March 16, 2015;

getting a portion of that payment. They will use three Form

June 15, 2015; and September 15, 2015. Their owners are all

OR-19s for their annual report and the total in column (d)

individuals who file using a calendar tax year, so the LLC

on the third form must be $3,500.

chooses to use the exception. Because the owners report this

income in their 2015 calendar tax year as required by IRS and

If the PTE wants any portion of a payment to go to its Form

Oregon laws, the payment due dates are April 15, 2015; June

OC account because some or all of the owners will be join-

15, 2015; September 15, 2015; and January 15, 2016.

ing the composite return, enter “Form OC” and the type of

owners and the amount from each payment. If filing Form

Use Form TPV-19 to remit the payments.

OC for different types of owners, a separate entry is needed

for each owner type.

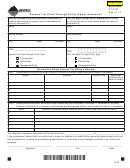

Form OR-19 instructions

For example, XYZ LLC sent in payments using voucher

Use Form OR-19 at the end of the tax year to show how

Form TPV-19 and now determines that all the nonresident

much of each payment belongs to each nonresident owner.

owners will be joining the Form OC. They have both indi-

Do not include owners who are exempt, joining a composite

vidual and corporate owners joining the Form OC. On their

return, or filed an affidavit. Complete Form OR-19, identify-

Form OR-19 annual report, they will make two entries. On

ing the entity that paid the tax and each nonresident owner’s

line 1 they will enter “Form OC” in column (b) and “I” in

information. Remember to use the individual or corpora-

column (c) along with the amount of each payment for the

tion owner’s information for disregarded entities. Each line

individual owners. On line 2 they will enter “Form OC” in

should be only one taxpayer, so enter spouses separately.

column (b) and “C” in column (c) along with the amount of

You must complete the name, tax identification number, and

each payment for the corporate owners.

150-101-182 (Rev. 12-14)

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6