Pass-Through Entity Owner Payments And Oregon Affidavit - 2015 Page 6

ADVERTISEMENT

Clear This Page

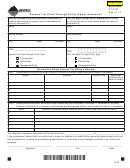

Oregon Affi davit

for a Nonresident Owner of a Pass-Through Entity

For offi ce use only

Date received

Beginning with tax year:

Nonresident owner information

Name of nonresident owner

Social Security no. or federal employer identifi cation no. (FEIN)

Street or mailing address

Oregon business identifi cation no. (BIN) (if applicable)

City

State

ZIP code

Phone number

(

)

Ownership percentage

Estimated Oregon-source distributive income each year

%

$

Pass-through entity information

Name of pass-through entity (PTE)

FEIN

Street or mailing address

BIN

City

State

ZIP code

Phone number

(

)

This form must be resubmitted if the PTE information entered above changes or ownership changes by 10% or more. See Form OR-19 and Oregon Affi davit instructions.

Agreement to fi le

I agree to timely fi le all required Oregon income or excise tax return(s) and to make timely payments of all taxes imposed by

the state of Oregon with respect to my share of the Oregon distributive income from the pass-through entity named above. I

understand that I am subject to the jurisdiction of the state of Oregon for purposes of the collection of unpaid income

tax, together with related penalties and interest.

Signature

Taxpayer’s or authorized agent’s signature

Date

X

Revocation of this affi davit

By signing below, I declare that:

I am an Oregon resident;

I am subject to tax on the income from the above-listed PTE;

I am no longer an owner in the above-listed PTE; or

I am joining in the fi ling of an Oregon Composite Return.

Signature

Taxpayer’s or authorized agent’s signature

Date

X

Mail to: Oregon Department of Revenue

ATTN: Processing Center

955 Center St NE

Salem OR 97301-2555

150-101-175 (Rev. 12-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6