Pass-Through Entity Owner Payments And Oregon Affidavit - 2015 Page 5

ADVERTISEMENT

Clear This Page

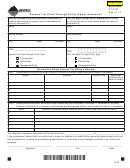

Annual Report of Nonresident Owner Tax Payments

Form

OR-19

2015

Entity tax year end date

Pass-through entity information

Pass-through entity (PTE) name

PTE FEIN

Check date

Estimated payments

Amount of payment

(MM/DD/YYYY)

PTE address

PTE BIN

Payment 1

.00

City

State

ZIP code

Contact phone

Payment 2

.00

Name of contact person

Payment 3

.00

Partnership

S Corporation

LLC

LLP

LP

Payment 4

Type of entity:

.00

FEIN/SSN

Name and address

Owner type

Payment 1

Payment 2

Payment 3

Payment 4

Total for

(a)

(b)

(c)

(d)

(e)

(f)

(g)

owner (h)

1.

$

.00 $

.00 $

.00 $

.00 $

.00

2.

$

.00 $

.00 $

.00 $

.00 $

.00

3.

$

.00 $

.00 $

.00 $

.00 $

.00

4.

$

.00 $

.00 $

.00 $

.00 $

.00

5.

$

.00 $

.00 $

.00 $

.00 $

.00

6.

$

.00 $

.00 $

.00 $

.00 $

.00

7.

$

.00 $

.00 $

.00 $

.00 $

.00

Total payments

(Enter on last page only. Must match payments 1–4 listed above.)

$

.00 $

.00 $

.00 $

.00

Page

of

Mail this form to: Oregon Department of Revenue, P.O. Box 14950 Salem, OR 97309-0950

This form is due by the end of the second month after the end of the entity’s tax year. The due date for entities using a calendar 2015 tax year is February 29, 2016.

150-101-182 (Rev. 12-14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6