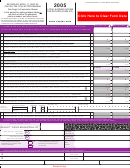

Form I301 - Local Earned Income Tax Return - Berkheimer Tax Administrator Page 4

ADVERTISEMENT

QUESTIONS AND ANSWERS ABOUT THE EARNED INCOME TAX

I306-2

I302-2

(YOUR TAX RETURN COPY IS ON THE BACK OF THIS FORM)

09/07

What Is The “Earned Income Tax?”

Earned Income is defined as compensation as determined under section 303 of the act of March 4, 1971 (P.L. 6, No.2), known as the Tax Reform

Code of 1971, 'and regulations in 61 PA. Code Pt. I subpt. B. Art. V (relating to personal income tax). Employee business expenses are

allowable deductions as determined under Article III of the Tax Reform Code of 1971.' The amount of any housing allowance provided to a

member of the clergy shall not be taxable as earned income. Net profits are defined as the net income from the operation of a business,

profession, or Tax Reform Code of 1971,' and regulations in 61 PA. Code Pt. I subpt. B. Art. V (relating to personal income tax). The term

does not include income which is not paid for services provided and which is in the nature of earnings from an investment.

For taxpayers engaged in the business, profession or activity of farming, the term shall not include:

(1) any interest earnings generated from any monetary accounts or investment instruments of the farming business;

(2) any gain on the sale of farm machinery;

(3) any gain on the sale of livestock held twelve months or more for draft, breeding or dairy purposes; and

(4) any gain on the sale of other capital assets of the farm.

What Income Is Specifically Exempt From The Earned Income Tax?

Income such as dividends, interest, income from trusts, bonds, insurance proceeds and stocks (Schedule D) is exempt. Also exempt are

payments for disability benefits, old age benefits, retirement pay, pensions, social security payments, public assistance or unemployment

compensation payments made by any governmental agency, any wages or compensation paid by the United States for active service in the

armed forces of the United States including bonuses or additional compensation for such service, supplemental unemployment compensation

from employers or unions.

If The Tax Is Withheld In Another PA Community Where I Work, Do I Also Pay The PA District In Which I Live?

No. Generally the tax withheld by your employer will be remitted to your resident taxing jurisdiction. However, you are still required to file

an annual tax return with your resident taxing jurisdiction.

If I Am Subject To The Philadelphia Wage Tax, Must I Also Pay This Tax?

No, but you are still required to file a final return. If employed in Philadelphia, you may use the Philadelphia Wage Tax as a credit against your

liability to your resident jurisdiction, but the credit may not exceed the tax rate printed on the enclosed return. No refund or credit can be taken

for any withholding greater than the current tax rate for your resident taxing jurisdiction. Philadelphia Wage Tax credits may not be applied to

your spouse’s liability.

Whose Earned Income Tax Will Be Withheld By Their Employer?

Any individual working in a jurisdiction that levies the tax on residents and non-residents will have the tax withheld by their employer. If

you work in a jurisdiction that does NOT tax non-residents, your employer is only required to withhold for those individuals who live in that

jurisdiction. Occasionally, employers located in a jurisdiction where the tax is not levied will volunteer to withhold if your resident jurisdiction

levies the tax.

Must All Taxpayers File A Final Return?

Yes. A Local Earned Income Tax Return must be filed annually by April 15, (unless the 15th falls on a Saturday or Sunday then the due date

becomes the next business day) for the preceding calendar year. If you had no earned income, state the reason on the enclosed tax return.

What Should I Do If I Lived In A Jurisdiction/Municipality For Only Part Of A Year?

You are required to file a return for any period of time you were/are a resident of a municipality for which Berkheimer is the Tax Administrator.

You are required to file for the period of time that you lived in that municipality and prorate your income, expense, withholding, etc. Also you

must complete the Part Year Resident Section on the top (front and back) of your Local Earned Income Tax Return to determine the tax

liability to each taxing district.

What Documentation Do I Need To Submit With The Final Return?

You should submit documentation which sufficiently supports the amount reported on each line of your return, including but not limited to,

W-2s, Federal / State Business Reporting Schedules, Expense Schedules, etc. Refer to each line of the enclosed tax return and instructions for

the specific form or schedule required. Photocopies are acceptable.

Where Is My Earned Income Reported On My W-2?

Your local earned income should be reported in the box labeled “Local Wages, tips, Etc.” (Please note: If the amount reported in the Local box

is substantially less than the amount reported as State Wages, Tips or other compensation, then you should submit an explanation for this

difference). Your local earned income should be reported in the box labeled “Local Income Tax.” If this box is not completed, then you should

refer to the box labeled "State Wages." Please note if you are employed out of state you should be referring to the box labeled “Medicare Wages.”

What If I Neither File A Return Nor Pay The Tax Due?

State law, as well as the local tax resolutions and/or ordinances, make it a summary criminal offense if a taxpayer fails to file a tax return as

required. This subjects the taxpayer to a fine not to exceed $500.00 per offense, plus the cost of prosecution. In default of payment of said

fine and costs, the taxpayer may be imprisoned for a period not exceeding thirty (30) days per offense. In addition, distress sale, wage

attachment and/or civil suit proceedings may be used to collect any unpaid tax found to be due, and penalties and interest may also be assessed.

Can I file online?

Visit us at for online filing eligibility.

What Return Address Label Do I use?

If there is a PAYMENT DUE for one or both of the taxpayers, then use the PAYMENT ENCLOSED label.

If there is NO PAYMENT enclosed with your return AND there is a REFUND OR CREDIT DUE for one or both of the taxpayers, then

use the REFUND OR CREDIT DUE label.

If there is NO PAYMENT and NO REFUND OR CREDIT for both of the taxpayers, then use the NO PAYMENT/NO REFUND label.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5