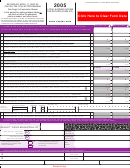

Form I301 - Local Earned Income Tax Return - Berkheimer Tax Administrator Page 5

ADVERTISEMENT

I306

9/07

LOCAL EARNED INCOME TAX RETURN

610-599-3139

YOUR COPY

KEEP for Your Records

Tax Rate __________ Tax Year __________

Tax Jurisdiction ________________________

Your S. S. #

Spouse's S. S. #

* SEE INSTRUCTION SHEET FOR DETAILS *

1.

.........

1

Gross Earnings as reported on W-2. Enclose W-2(s) with your return (photocopies of W-2s are accepted)

2.

Allowable Non-reimbursed Employee Business expenses. (See Instructions Line 2)

............................................. 2

3. Taxable W-2 earnings (1 minus 2)

.... 3

Audit may be required if all W-2s & supporting schedules are not enclosed

4. Net Loss (Use line 6 for any Net profits)

(See Instructions Line 4) ............................................................ 4

5. Subtotal (Line 3 minus line 4) IF LESS THAN ZERO, ENTER ZERO .................................................... 5

6. Net Profits (Use line 4 for any Net losses)

(See Instructions Line 6) ...........................................

.......... 6

7. Total Earned Income subject to this tax (Line 5 plus line 6) .......................................................................... 7

8. Tax Liability - Line 7 multiplied by Tax rate printed on tax return................................................................ 8

9. Quarterly Estimated Payments .......................................................................................................................... 9

10. Earned Income Tax Withheld as per W-2 (See instructions line 10) .............................................................. 10

11. Credit from last year (If Credit Due)................................................................................................................ 11

12. Miscellaneous credits (i.e. Philadelphia Tax or Out-of-State Tax Credit - see reverse) .................................. 12

13. Total of 9 + 10 + 11 + 12 ................................................................................................................................ 13

14. REFUND / CREDIT: (Line 13 minus line 8) IF $1.00 OR MORE, enter amount and check one box below:

14

Credit to Spouse

Credit to next year

Refund

NO REFUNDS OR CREDITS UNDER $1.00

15. TAX DUE: (Line 8 minus line 13) OMIT IF LESS THAN $1.00 ................................................................ 15

16. Interest & Penalties... LEAVE BLANK IF PAID WHEN DUE .......................................................................... 16

17. TOTAL AMOUNT DUE (lines 15 + 16) ...................................................................................................... 17

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and

collection of local taxes by calling Berkheimer at 610-599-3139, during the hours of 9:00 a.m. through 4:30 p.m., Monday

through Friday. Or, you can visit our website at or contact us by e-mail at . If

Berkheimer is not the appointed tax hearing officer for your taxing district, you must contact your

taxing district about the proper procedures and forms necessary to file an appeal.

* QUESTIONS AND ANSWERS ON REVERSE SIDE *

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5