Form I301 - Local Earned Income Tax Return - Berkheimer Tax Administrator Page 2

ADVERTISEMENT

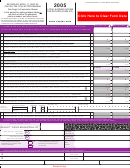

LOCAL EARNED INCOME TAX RETURN

I301

9/07

A. GENERAL INSTRUCTIONS

1. WHEN TO FILE: This return must be completed and filed by all persons subject to the tax on or before April 15 (unless the 15th is a Saturday

or Sunday then file the next business day), regardless of whether or not tax is due. If you file a Federal or State Application for Extension,

check the extension box on the front of the form and send this form along with your estimated payment by April 15, unless the 15th is a

Saturday or Sunday, then by the next business day. If you use a professional tax preparer, please verify whether you need to file your return

by mail or whether you have filed your return online.

2. WHERE TO FILE: Remit to the address printed on the tax return or see if you are eligible to file online at

3. EFFECTIVE DATES: January 1 through December 31, unless otherwise noted on your Local Earned Income Tax Return.

4. AMENDED RETURN: If a taxpayer amends his federal income tax return, an amended Local Earned Income Tax Return must also be filed

with this office.

5. RECEIPT / COPY: Your cancelled check is sufficient proof of payment. The Question & Answer sheet is your copy of your tax return.

Any individual requesting a photocopy of their return will be charged a $5.00 administrative fee. Please submit your request and payment

along with a self-addressed stamped envelope.

6. PENALTY AND INTEREST: If for any reason the tax is not paid when due, Penalty and Interest will be charged.

7. Use exact figures. Do not round.

8. USE BLACK INK OR #2 PENCIL ONLY WHEN COMPLETING THIS FORM.

B. REGULATIONS/LINE BY LINE INSTRUCTIONS

LINE 1: GROSS EARNINGS FOR SERVICES RENDERED

DOCUMENTATION REQUIRED: W-2(S) must be enclosed (photocopies are accepted).

TAXABLE INCOME INCLUDES: Salaries; Wages; Commissions; Bonuses; Tips; Stipends; Fees; Incentive Payments; Employee

Contributions to Retirement Accounts; Compensation Drawing Accounts (If amounts received as a drawing account exceed the salaries

or commission earned, the tax is payable on the amounts received. If the employee subsequently repays to the employer any amounts

not in fact earned, the tax shall be adjusted accordingly); Benefits accruing from the employment, such as: Annual Leave, Vacation,

Holiday, Separation, Sabbatical Leave; Income from patents and royalties; Compensation received in the form of property shall be

taxed at its fair market value at the time of receipt; Jury Duty Pay; Payments received from weekend meetings for National Guard or

Reserve Units; Sick Pay, if employee received a regular salary during period of sickness or disability by virtue of his agreement of

employment; Taxes assumed by the Employer.

NONTAXABLE INCOME INCLUDES: Social Security Benefits; Unemployment Compensation; Pensions; Public Assistance;

Death Benefits; Gifts; Interest; Dividends; Boarding and Lodging to employees for convenience of employer; Lottery Winnings;

Supplementary unemployment benefits (sub pay); Capital Gains (Capital losses may not be used as a deduction against other taxable

income); disability benefits (Periodical payments received by an individual under a disability insurance plan.); Active military service

and summer encampment; personal use of company cars; cafeteria plans; and clergy housing allowance. All forms of payments from

Individual Retirement Programs, such as Keogh, Tax Shelter Annuity, IRA, and 401K are not taxable. Taxpayer should refer to the PA

Department of Revenue regulations regarding taxable compensation.

LINE 2: ALLOWABLE EMPLOYEE BUSINESS EXPENSES

DOCUMENTATION REQUIRED: Pennsylvania form PA-UE must be enclosed (photocopies are accepted).

LINE 3:TAXABLE EARNINGS: Subtract line 2 from line 1.

LINE 4: NET LOSS FROM BUSINESS

DOCUMENTATION REQUIRED: PA schedules C, E, F, or K-1 must be enclosed (photocopies are accepted).

RULE: A taxpayer may offset a business loss against wages and other compensation (W-2 earnings -- line 1). "Pass-through" income

from an S-Corporation is NOT taxable and loss is not deductible. A taxpayer may not offset a loss from one business entity against a

net profit from another business entity. If the taxpayer is in the business of renting real estate then file page 1 of Schedule E. All

allowable business losses must be reported on line 4.

LINE 5: SUBTOTAL: Line 3 minus Line 4. If less than zero, enter zero.

LINE 6: NET PROFITS FROM BUSINESS

DOCUMENTATION REQUIRED: 1099(s), PA Schedules C, E, F, or K-1 must be enclosed (photocopies are accepted).

The net profits of a business, trade, profession, or other activity shall be computed by subtracting from gross receipts the cost of goods

sold and all ordinary and necessary expenses of doing business. Generally, a business deduction which is not permitted by the Federal

Government for income tax purposes will not be allowed. Not all self-employed income is includable as taxable earnings: Rentals

from real estate and from personal property leased with the real estate is not included, unless reportable on Schedule C, or if the

taxpayer is in the business of renting real estate then file page 1 of Schedule E. Gain or loss from the sale of capital assets is not

included in the computation of net profits.

LINE 7: TOTAL EARNED INCOME subject to tax: Add lines 5 and 6.

LINE 8: TAX LIABILITY: Multiply line 7 by tax rate printed on the tax return. For example, if 1% use .01, if 1/2% use .005.

LINE 9: QUARTERLY ESTIMATED PAYMENTS: List any quarterly estimated payments made to date for appropriate filing year. Do not

include any penalty and interest amounts that may have been made with the quarterly payments.

LINE 10: EARNED INCOME TAX WITHHELD: You may claim credit for local tax withheld as shown on your W-2 form, but only up to the

rate of tax printed on line 8 of the tax return. Do not claim entire amount of tax withheld if it is greater than the tax rate for your

resident taxing jurisdiction.

LINE 11: PRIOR YEAR CREDIT: State the amount of tax overpaid as listed on your previous year's return to be applied to current

tax liability.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5