Income Withholding For Support Page 2

Download a blank fillable Income Withholding For Support in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Income Withholding For Support with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

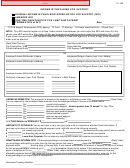

Employer's Name:

Employer FEIN:

Employee/Obligor's Name:

SSN:

Case Identifier:

Order Identifier:

REMITTANCE INFORMATION: If the employee/obligor's principal place of employment is

(State/Tribe), you must begin withholding no later than the first pay period that occurs

days after the date

of

. Send payment within

business days of the pay date. If you cannot withhold the full amount of

support for any or all orders for this employee/obligor, withhold

% of disposable income for all orders. If the obligor is

a non-employee, obtain withholding limits from Supplemental Information. If the employee/obligor's principal place of

employment is not

(State/Tribe), obtain withholding limitations, time requirements,

and any allowable employer fees from the jurisdiction of the employee/obligor's principal place of employment. State-

specfic withholding limit information is available at

program-requirements. For tribe-specific contacts, payment addresses, and withholding limitations, please contact the

tribe at

or

https://

For electronic payment requirements and centralized payment collection and disbursement facility information [State

Disbursement Unit (SDU)], see

Include the Remittance ID with the payment and if necessary this locator code:

.

Remit payment to

(SDU/Tribal Order Payee)

at

(SDU/Tribal Payee Address)

Return to Sender (Completed by Employer/Income Withholder). Payment must be directed to an SDU in

accordance with sections 466(b)(5) and (6) of the Social Security Act or Tribal Payee (see Payments to SDU below). If

payment is not directed to an SDU/Tribal Payee or this IWO is not regular on its face, you must check this box and return

the IWO to the sender.

If Required by State or Tribal Law:

Signature of Judge/Issuing Official:

Print Name of Judge/Issuing Official:

Title of Judge/Issuing Official:

Date of Signature:

If the employee/obligor works in a state or for a tribe that is different from the state or tribe that issued this order, a copy of

this IWO must be provided to the employee/obligor.

If checked, the employer/income withholder must provide a copy of this form to the employee/obligor.

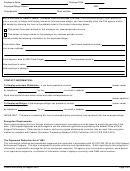

ADDITIONAL INFORMATION FOR EMPLOYERS/INCOME WITHHOLDERS

State-specific contact and withholding information can be found on the Federal Employer Services website located at

program-requirements.

Employers/income withholders may use OCSE's Child Support Portal (https://ocsp.acf.hhs.gov/csp/) to provide

information about employees who are eligible to receive a lump sum payment, have terminated employment, and to

provide contacts, addresses, and other information about their company.

Priority: Withholding for support has priority over any other legal process under State law against the same income

(section 466(b)(7) of the Social Security Act). If a federal tax levy is in effect, please notify the sender.

Combining Payments: When remitting payments to an SDU or tribal CSE agency, you may combine withheld amounts

from more than one employee/obligor's income in a single payment. You must, however, separately identify each

employee/obligor's portion of the payment.

Payments To SDU: You must send child support payments payable by income withholding to the appropriate SDU or to a

tribal CSE agency. If this IWO instructs you to send a payment to an entity other than an SDU (e.g., payable to the

custodial party, court, or attorney), you must check the box above and return this notice to the sender. Exception: If this

IWO was sent by a court, attorney, or private individual/entity and the initial order was entered before January 1, 1994 or

the order was issued by a tribal CSE agency, you must follow the “Remit payment to” instructions on this form.

Page 2 of 4

Income Withholding for Support (IWO)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4