Income Withholding For Support Page 3

Download a blank fillable Income Withholding For Support in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Income Withholding For Support with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

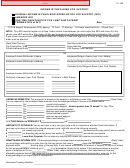

Employer's Name:

Employer FEIN:

Employee/Obligor's Name:

SSN:

Case Identifier:

Order Identifier:

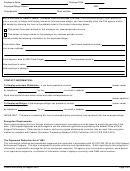

Reporting the Pay Date: You must report the pay date when sending the payment. The pay date is the date on which the

amount was withheld from the employee/obligor's wages. You must comply with the law of the state (or tribal law if

applicable) of the employee/obligor's principal place of employment regarding time periods within which you must

implement the withholding and forward the support payments.

Multiple IWOs: If there is more than one IWO against this employee/obligor and you are unable to fully honor all IWOs

due to federal, state, or tribal withholding limits, you must honor all IWOs to the greatest extent possible, giving priority to

current support before payment of any past-due support. Follow the state or tribal law/procedure of the employee/obligor's

principal place of employment to determine the appropriate allocation method.

Lump Sum Payments: You may be required to notify a state or tribal CSE agency of upcoming lump sum payments to

this employee/obligor such as bonuses, commissions, or severance pay. Contact the sender to determine if you are

required to report and/or withhold lump sum payments.

Liability: If you have any doubts about the validity of this IWO, contact the sender. If you fail to withhold income from the

employee/obligor's income as the IWO directs, you are liable for both the accumulated amount you should have withheld

and any penalties set by state or tribal law/procedure.

Anti-discrimination: You are subject to a fine determined under state or tribal law for discharging an employee/obligor

from employment, refusing to employ, or taking disciplinary action against an employee/obligor because of this IWO.

Withholding Limits: You may not withhold more than the lesser of: 1) the amounts allowed by the Federal Consumer

Credit Protection Act (CCPA) [15 USC §1673 (b)]; or 2) the amounts allowed by the law of the state of the employee/

obligor's principal place of employment, if the place of employment is in a state; or the tribal law of the employee/obligor's

principal place of employment if the place of employment is under tribal jurisdiction. Disposable income is the net

income after mandatory deductions such as: state, federal, local taxes; Social Security taxes; statutory pension

contributions; and Medicare taxes. The federal limit is 50% of the disposable income if the obligor is supporting another

family and 60% of the disposable income if the obligor is not supporting another family. However, those limits increase

5% --to 55% and 65% --if the arrears are greater than 12 weeks. If permitted by the state or tribe, you may deduct a fee

for administrative costs. The combined support amount and fee may not exceed the limit indicated in this section.

Depending upon applicable state or tribal law, you may need to consider amounts paid for health care premiums in

determining disposable income and applying appropriate withholding limits.

Arrears Greater Than 12 Weeks? If the Order Information section does not indicate that the arrears are greater than

12 weeks, then the employer should calculate the CCPA limit using the lower percentage.

Supplemental Information:

Page 3 of 4

Income Withholding for Support (IWO)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4