Page 3

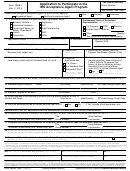

13551

Department of the Treasury - Internal Revenue Service

OMB Number

Form

Continuation Sheet for Additional Authorized Representatives

1545-1896

(Rev. August 2014)

(see Form 13551 instructions)

Legal Name of the Business (Page 1, Line 2 (and 11, if applicable))

Business EFIN

Business EIN

Business location address

Street

City/County

State/Country

ZIP Code/Foreign Postal Code

Information and Signature of Additional Authorized Representative

Professional Status of

5. Name and PTIN of Authorized Representative of

6. Date of birth

7. Social Security Number (SSN) or Taxpayer

Authorized

the Business (first, middle, last, PTIN)

(month, day, year)

Identification Number (ITIN)

Representative (Line 5)

Tax Preparer

8. Home address (street, city/county, state/country,

9. Check the appropriate box

10. Have you ever been assessed any preparer

CPA*

and ZIP code/foreign postal code) of individual

penalties, been convicted of a crime, failed to

U.S. Citizen

file personal tax returns, or pay tax liabilities,

listed on Line 5

Attorney*

or been convicted of any criminal offense

U.S. Resident Alien*

Enrolled Agent*

under the U.S. Internal Revenue laws

Nonresident Alien*

Yes

No

number

*Attach copy of green card

(Please attach an explanation for a “Yes”

Other

or visa if residing in the U.S.

response.)

*See instructions for

proof requirements

13. Business telephone number

Fax number

14. Mailing address of the Business if different from the location address on line 12

(

)

(

)

Number and street

City/County

State/Country

ZIP Code/Foreign Postal Code

Email

Under the penalties of Perjury, I declare that I have examined this application and read all accompanying information, and to the best of my knowledge and belief, the information being

provided is true, correct, and complete. I or my institution and its employees acting on behalf of the institution will comply with all of the provisions of the Revenue Procedure for

Acceptance Agents and related publications each year of our participation.

Acceptance for participation is not transferable. I understand that if this institution is sold or its organizational structure changes, a new application must be filed. I further understand that

noncompliance will result in the institution and/or the individuals listed on this application, being suspended from participation in the IRS Acceptance Agent Program. I am authorized to

make and sign this statement on behalf of the institution.

Signature of Authorized Representative

Name and title of Authorized Representative from line 5 (type or print)

Date

Information and Signature of Additional Authorized Representative

Professional Status of

5. Name and PTIN of Authorized Representative of

6. Date of birth

7. Social Security Number (SSN) or Taxpayer

Authorized

the Business (first, middle, last, PTIN)

(month, day, year)

Identification Number (ITIN)

Representative (Line 5)

Tax Preparer

8. Home address (street, city/county, state/country,

9. Check the appropriate box

10. Have you ever been assessed any preparer

CPA*

and ZIP code/foreign postal code) of individual

penalties, been convicted of a crime, failed to

U.S. Citizen

file personal tax returns, or pay tax liabilities,

listed on Line 5

Attorney*

or been convicted of any criminal offense

U.S. Resident Alien*

Enrolled Agent*

under the U.S. Internal Revenue laws

Nonresident Alien*

Yes

No

number

*Attach copy of green card

(Please attach an explanation for a “Yes”

Other

or visa if residing in the U.S.

response.)

*See instructions for

proof requirements

13. Business telephone number

Fax number

14. Mailing address of the Business if different from the location address on line 12

(

)

(

)

Number and street

City/County

State/Country

ZIP Code/Foreign Postal Code

Email

Under the penalties of Perjury, I declare that I have examined this application and read all accompanying information, and to the best of my knowledge and belief, the information being

provided is true, correct, and complete. I or my institution and its employees acting on behalf of the institution will comply with all of the provisions of the Revenue Procedure for

Acceptance Agents and related publications each year of our participation.

Acceptance for participation is not transferable. I understand that if this institution is sold or its organizational structure changes, a new application must be filed. I further understand that

noncompliance will result in the institution and/or the individuals listed on this application, being suspended from participation in the IRS Acceptance Agent Program. I am authorized to

make and sign this statement on behalf of the institution.

Signature of Authorized Representative

Name and title of Authorized Representative from line 5 (type or print)

Date

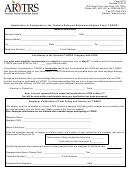

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Your response is voluntary. You

are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records

relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return

information are confidential, as required by code section 6103. The estimated average time to complete this form is 30 minutes. If you have comments concerning the accuracy of this

time estimate or suggestions for making this form simpler, we will be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:

W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224. Do NOT send this form to this address. Instead, enclose it with the magnetic tape and send it to the Service

Center to which you submit your tapes or send it to the transmission reception site that received your transmitted returns.

13551

Catalog Number 38262Q

Form

(Rev. 8-2014)

1

1 2

2 3

3 4

4