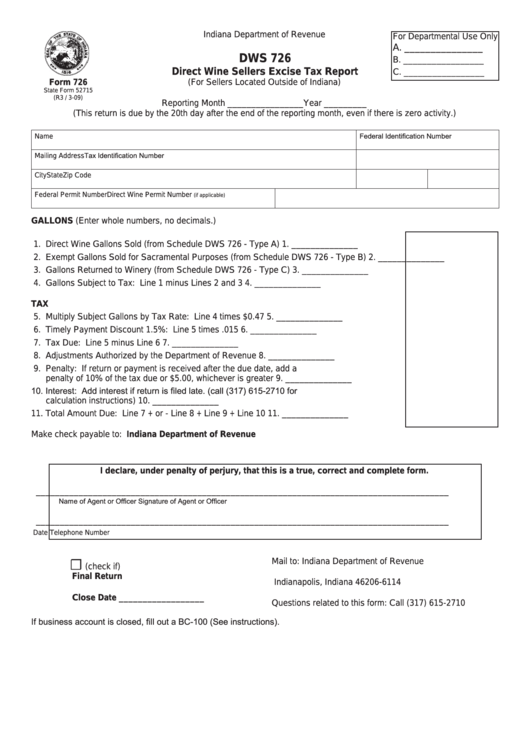

Indiana Department of Revenue

For Departmental Use Only

A. _______________

DWS 726

B. _________________

Direct Wine Sellers Excise Tax Report

C. _________________

Form 726

(For Sellers Located Outside of Indiana)

State Form 52715

(R3 / 3-09)

Reporting Month ________________Year _________

(This return is due by the 20th day after the end of the reporting month, even if there is zero activity.)

Federal Identification Number

Name

Tax Identification Number

Mailing Address

City

State

Zip Code

Federal Permit Number

Direct Wine Permit Number

(if applicable)

GALLONS (Enter whole numbers, no decimals.)

1. Direct Wine Gallons Sold (from Schedule DWS 726 - Type A)

1. ______________

2. Exempt Gallons Sold for Sacramental Purposes (from Schedule DWS 726 - Type B)

2. ______________

3. Gallons Returned to Winery (from Schedule DWS 726 - Type C)

3. ______________

4. Gallons Subject to Tax: Line 1 minus Lines 2 and 3

4. ______________

TAX

5. Multiply Subject Gallons by Tax Rate: Line 4 times $0.47

5. ______________

6. Timely Payment Discount 1.5%: Line 5 times .015

6. ______________

7. Tax Due: Line 5 minus Line 6

7. ______________

8. Adjustments Authorized by the Department of Revenue

8. ______________

9. Penalty: If return or payment is received after the due date, add a

penalty of 10% of the tax due or $5.00, whichever is greater

9. ______________

10. Interest: Add interest if return is filed late. (call (317) 615-2710 for

calculation instructions)

10. ______________

11. Total Amount Due: Line 7 + or - Line 8 + Line 9 + Line 10

11. ______________

Make check payable to: Indiana Department of Revenue

I declare, under penalty of perjury, that this is a true, correct and complete form.

_______________________________________________________________________________________

Name of Agent or Officer

Signature of Agent or Officer

_______________________________________________________________________________________

Date

Telephone Number

☐

Mail to: Indiana Department of Revenue

(check if)

P.O. Box 6114

Final Return

Indianapolis, Indiana 46206-6114

Close Date __________________

Questions related to this form: Call (317) 615-2710

If business account is closed, fill out a BC-100 (See instructions).

1

1 2

2