Important Information for 2012

Estimates

Michigan Business Tax (MBT) Instruction

All estimated payments, extension payments, and tax returns

Differences for Calendar, Fiscal Year Filers

must be filed under the UBG’s DM.

This MBT booklet includes forms and instructions designed

If making estimated payments by Electronic Funds Transfer

for the calendar year 2012, and for the portion of the tax year

in 2012 for financial institutions with a federal fiscal year

(EFT), the associated vouchers are not required to be

beginning in 2011 and ending in 2012. All filers should read the

submitted.

instructions carefully.

Amended Returns

NOTE: Per Public Act 39 of 2011, the Corporate Income Tax

To amend a current or prior year annual return, complete the

(CIT) replaces the MBT for most taxpayers effective January

Form 4590 that is applicable for that year, check the box in the

1, 2012. After that date, the MBT continues as the MBT

upper-right corner of the return, and attach a separate sheet

election. Beginning January 1, 2012, only those taxpayers with

explaining the reason for the changes. Include an amended

a certificated credit, which is awarded but not yet fully claimed

federal return or a signed and dated Internal Revenue Service

or utilized, may elect to be MBT taxpayers. If a taxpayer files

(IRS) audit document. Include all schedules filed with the

an MBT return and claims a certificated credit, the taxpayer

original return, even if not amending that schedule. Enter

makes the election to file and pay under the MBT until the

the figures on the amended return as they should be. Do not

certificated credit and any carryforward of that credit are

include a copy of the original return with your amended return.

exhausted. For most certificated credits, a taxpayer must claim

the credit and elect to remain taxable under the MBT with the

Changes for Disregarded Entities

annual return filed for taxpayer’s first tax year ending after

Public Act 305 was enacted into law on December 27, 2011,

December 31, 2011. Once the election is made and the return is

to add Michigan Compiled Law 208.1512 to the MBT. This

submitted, the taxpayer may not amend the return to revoke the

section provides that for tax years ending on January 1, 2012

election.

and after January 1, 2012, a person that is a classified as a

disregarded entity for federal purposes must be classified

A financial institution with a federal fiscal year beginning in

as a disregarded entity for MBT purposes. This means that

2011 and ending in 2012 must file two short-period returns,

a disregarded entity for federal tax purposes, including a

one to report its final 2011 MBT liability, for the period from

single member LLC or Q-Sub, must file as if it were a sole

the beginning of its 2011-12 fiscal year through December 31,

proprietorship if it is owned by an individual, or a branch or

2011, and the second to report either its initial CIT liability,

division if the branch or division is owned by another business

for the period from January 1, 2012, to the ending of its 2011-

12 fiscal year, or, for taxpayers electing to continue MBT to

entity.

claim certificated credits, a 2012 MBT return for the period

Accelerated Credits in 2012

from January 1, 2012, to the ending of its 2011-12 fiscal year.

A taxpayer with a certificated credit under section 435

If a person with a certificated credit is a member of a UBG,

(Historic) or 437 (Brownfield) of the Michigan Business

the Designated Member of the UBG, and not the member, shall

Tax Act (MBTA), which certificated credit or any unused

file a UBG return and pay the tax, if any, under the MBTA and

carryforward may be claimed in a tax year ending after

claim that certificated credit.

December 31, 2011, may elect to pay the tax imposed by the

If a financial institution does not have a certificated credit,

MBTA in the tax year in which that certificated credit may

it cannot make the MBT election and is subject to the CIT.

be claimed in lieu of the CIT. If a person with a certificated

This year the completion of some forms will vary depending

credit under section 435 or 437 that elects to pay the MBT is a

on whether the taxpayer is a fiscal year filer. These fiscal filer

member of a Unitary Business Group (UBG), the Designated

differences are detailed in the “2012 Supplemental Instructions

Member of the UBG, and not the member, shall file a UBG

for Fiscal MBT Filers – Financial Institutions” later in this

return and pay the tax, if any, under the MBTA and claim that

booklet.

certificated credit.

For a tax year beginning after December 31, 2011, if a

Helpful Hints for Completing an MBT Return

certificate of completion, assignment certificate, or component

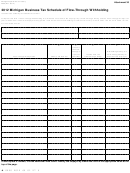

MBT UBG Combined Filing Schedule for Financial

completion certificate is issued under section 437 to a taxpayer,

Institutions (Form 4752)

or if a certificate of completed rehabilitation, assignment

certificate, or reassignment certificate is issued under section

Members of a UBG will report their data on Form 4752. Once

435 to a taxpayer, beginning on and after January 1, 2012,

all member data is combined and eliminations are calculated,

the taxpayer may elect to claim an accelerated refund for 90

these final figures will carry to Form 4590. All credits claimed

percent of the amount of that certificate.

on Form 4752 must be supported by the applicable forms and

these forms must be included when filing the return.

If section 437 or 435 provides that payment of a credit will be

made over a period of years or limits the annual amount of a

UBG members may have different tax year-ends. The combined

payment, an accelerated refund may only be claimed for the

return must include each member whose tax year ends with or

amount payable in the year claimed.

within the tax year of the Designated Member (DM).

2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42