4752, Page 4

Designated Member FEIN or TR Number

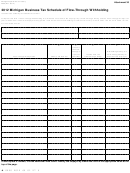

PART 3: AFFILIATES EXCLUDED FROM THE COMBINED RETURN OF FINANCIAL INSTITUTIONS

List every person (with or without nexus) for which the “greater than 50 percent” ownership test of a Michigan Unitary Business Group is satisfied, which is

not included on the combined return of financial institutions that is supported by this form. Using the codes below, identify in column D why each person is

not included in the combined return. If any persons listed here are part of a federal consolidated group, attach a copy of U.S. Form 851.

REASON CODES FOR EXCLUSION:

1. Lacks business activities resulting in a flow of value or integration,

6. Other.

dependence or contribution to group.

7. Insurance company. (Insurance companies always file separately.)

2. Foreign operating entity.

9. Standard taxpayers not owned by a financial institution. (Financial

4. Foreign entity.

institutions and standard taxpayers generally are not included on

the same combined return.)

5. Member has no MBT tax year (as a member of this UBG) ending

with or within this filing period.

37.

A

B

C

D

E

F

Number From

Reason

Check (X) if

U.S. Form 851

Code for

Nexus with

(if applicable)

Name

FEIN or TR Number

Exclusion

Michigan

NAICS Code

PART 4: PERSONS INCLUDED IN THE PRIOR COMBINED RETURN, BUT EXCLUDED FROM CURRENT RETURN

List persons included in the immediately preceding combined return of this Designated Member that are not included on the return supported by this form.

Persons that satisfy the criteria of Part 3 and Part 4 should be listed in each part. See column C instructions for a list of reason codes.

38.

A

B

C

Name

FEIN or TR Number

Reason This Person Is Not on Current Return

+

0000 2012 85 04 27 1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42