However, a taxpayer claiming the Special Consideration

The flow-through entities will be required to file four quarterly

Historic Preservation Credit under section 435(20) may elect to

returns and an annual return.

claim an accelerated refund for the balance of the credit, but

There will be no extensions granted to flow-through entities

the amount of that refund shall be equal to 86 percent of the

for their FTW Quarterly Return (Form 4917). However, fiscal

amount of the credit.

year taxpayers will be granted an automatic extension until

For more details, see the 2012 Request for Reduced Refundable

February 28, 2013, for their flow-through withholding annual

Credit Payout for the Brownfield Redevelopment Credit and

reconciliation return for the 2012 portion of their 2011-12

Historic Preservation Credit (Form 4889). Michigan Tax Forms

federal tax year.

are online at An accelerated credit

refund will be paid within 60 days after Form 4889 is filed.

Brief Overview of the CIT

The CIT takes effect January 1, 2012, and replaces the MBT,

except for certain businesses that wish to claim certificated

credits. Among the highlights of the CIT:

• The CIT applies

to all financial institutions unless the

financial institution is able to and does make the MBT election.

• Flow-through entities may be subject to Flow-Through

Withholding.

• For the 2012 tax year, fiscal year taxpayers will be granted

an automatic extension to file the annual return to April 30,

2013, regardless of whether they are filing a CIT return or an

MBT election return. However, an extension of time to file

is not an extension of time to pay. An extension request form

need not be filed unless required to transmit payment of any

tax that would be due with the annual return. The annual return

tax due must be paid by the original due date, which is the last

day of the fourth month after the end of the fiscal year.

• Taxpayers will be required to file quarterly estimated

returns as well as an annual return.

• Annual payments will still be due on the prescribed due date

of the annual return.

• The CIT is equal to 0.29% of net capital for financial

institutions.

• There are no credits available for financial institutions under

the CIT.

• An entity that has received, has been approved to receive,

or has been assigned certain certificated tax credits under

MBT may elect to continue to file and pay under the MBT in

lieu of the CIT. This election must be made with the annual

return filed for first tax period beginning after 2011 for most

certificated credits. The election is also made if a taxpayer files

a Form 4889, Claim for Accelerated Credit.

• Estimated payments will still be due on the prescribed due

dates for quarterly estimated returns.

For more information on the CIT, go online to

gov/taxes.

Overview of Flow-Through Withholding

Flow-through entities with non-resident individual owners

must withhold tax on the distributive share of each non-resident

individual owner. Beginning in 2012, flow-through entities

with more than $200,000 of business income reasonably

expected to accrue, after allocation or apportionment, will be

required to withhold a tax on the distributive share of each

owner that is a C Corporation or flow-through entity.

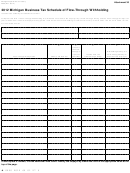

3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42