withheld on behalf of the taxpayer should have provided the

7

Insurance company. (Insurance companies always file

taxpayer with the amount for its records.

separately.)

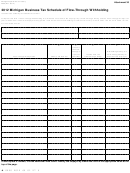

If an amount is entered on this line, complete the MBT

9

“Standard” taxpayers not owned by a financial

Schedule of Flow-Through Withholding (Form 4966) to

institution.

(Financial

institutions

and

“standard”

account for the Flow-Through Withholding payments received.

taxpayers are not included on the same combined return.)

The amount entered on this line must equal the sum of the

If you have questions, call the Michigan Department of

combined amount from Form 4966, column E.

Treasury, Technical Services Division, at (517) 636-4230, to

Line 36: Only the DM may request a filing extension for a UBG.

discuss an appropriate entry.

If any other member submits an extension request, it will not

Line 37E: If this person has nexus with Michigan, check this box.

create a valid extension for the UBG, but any payment included

with such a request can be credited to the UBG by entering that

Line 37F: Enter this person’s six-digit NAICS code. For a

payment on this line in that member’s copy of Part 2B.

complete list of six-digit NAICS codes, see the U.S. Census

Bureau Web site at , or enter

Part 3: Affiliates Excluded From the Combined

the same NAICS code used when filing U.S. Form 1120S, U.S.

Form 1065, Schedule C of U.S. Form 1040, or Schedule K of

Return of Financial Institutions

U.S. Form 1120.

The statutory test for membership in a UBG is a group of U.S.

persons (other than a foreign operating entity):

Part 4: Persons Included in the Prior Combined

Return, but Excluded From Current Return

• One of which owns or controls, directly or indirectly, more

The purpose of Part 4 is to assist Treasury in tracking

than 50 percent of the ownership interest with voting rights

membership changes of a UBG from year to year. If the reason

or ownership interests that confer comparable rights to voting

the person is not on this return is because it did not satisfy the

rights of the other U.S. persons; and

flow of value, etc., test at any time during the filing period, list

• That has business activities or operations which result in a

the person on line 36, and do not enter it here.

flow of value between or among persons included in the UBG

Line 38C: Reason codes for a person being included in last

or has business activities or operations that are integrated

year’s return but not on the combined return for financial

with, are dependent upon, or contribute to each other. Flow

institutions supported by this form:

of value is determined by reviewing the totality of facts and

circumstances of business activities and operations.

10 The member no longer meets the control test but the

A person that would be a standard taxpayer if viewed

ownership interest is still greater than zero.

separately is defined as a financial institution if it is owned,

12 The member no longer meets the control test and the

directly or indirectly, by a financial institution and is in a UBG

ownership interest is zero.

with its owner.

14 Before the beginning of the filing period for this return,

The purpose of Part 3 is to identify entities for which the

the person ceased to exist due to dissolution.

ownership test described above is satisfied but which are not

16 Before the beginning of the filing period for this return,

included on this combined return, either because the flow of

the person ceased to exist due to a merger or similar

value/integration/dependence/contribution test is not satisfied

combination.

or because the member is excluded by statute. A member

whose net capital is not included in this return because its tax

If the reason is not listed among these reason codes, describe

year ends after the filing period of the UBG also should be

the reason in 21 characters or less in the space provided.

listed here.

Line 37A: If a person being listed here is listed on

Other Supporting Forms and Schedules

U.S. Form 851, enter the identifying number for that person

For each member that files a separate federal return, attach

that is called “Corp. No.” at the left edge of pages 1, 2, and 3 of

copies of the same pages of that member’s federal return as are

U.S. Form 851.

required for a separate filer in similar circumstances. See the

Line 37D: Reason codes for affiliate being excluded from

“Attachments” section of Form 4590 instructions for guidance

on required pages of federal returns.

the combined return of financial institutions supported by this

form.

If some or all members reporting on the current combined

return are also members of a federal consolidated group, each

Lacks business activities resulting in a flow of value or

1

member will prepare its portion of this Form 4752 on the basis

integration, dependence, or contribution to group.

of a pro forma federal return. In this case, attach a copy of

2

Foreign operating entity.

the applicable pro forma form and schedules as listed in the

4

“Attachments” section of Form 4590 instructions.

Foreign entity.

Member has no MBT tax year (as a member of this

5

NOTE: A qualified federally disregarded entity that is

UBG) ending with or within this filing period.

eligible to and does file its MBT return as a separate entity

6

Other.

from its owner will prepare its MBT return on the basis of a

27

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42