subsidiaries, and entities in the same general line of business.

Annualizing

Flow of value must be more than the mere flow of funds arising

If the filing period is less than 12 months, annualize the prior

out of passive investment.

year’s tax liability to determine whether estimates may be

based on that liability. If the prior year’s annualized liability

2) The alternate “contribution/dependency” relationship test

is $20,000 or less, estimates may be based on the annualized

asks whether business activities are integrated with, dependent

amount if paid in four equal, timely, installments.

upon, or contributed to each other. Businesses are integrated

with, are dependent upon, or contribute to each other under

If annualization is required, multiply the prior year’s tax

many of the same circumstances that establish flow of value.

liability by 12 and divide the result by the number of months

However, this alternate relationship test is also commonly

the business operated. Generally, a business is considered in

satisfied when one entity finances the operations of another

business for a month if the business operated for more than half

or when there exist intercompany transactions, including

the days of that month. A business whose entire tax year is 15

financing.

days or less, however, is considered in business for one month.

For more information on the control and relationship tests

EXAMPLE: A fiscal year taxpayer with a tax year ending in

for UBGs, see RAB 2010-1, MBT—Unitary Business

June files a six-month return ending June 2010 reporting a tax

Group Control Test, and RAB 2010-2, MBT—Unitary

liability of $9,000. Estimates for the tax year ending June 2011

Business Group Relationship Tests, on Treasury’s Web site at

may be based on the annualized liability of $18,000. Estimates

(Click on the “Reference Library”

must be paid in four equal, timely installments of $4,500.

link on the left side of the page.)

Fiduciaries: A business registered as a Fiduciary that is in

business less than 12 months is not required to annualize.

Filing the Correct Form

A different primary return and instruction booklet are required

Due Dates of Annual Returns

for standard taxpayers (Form 4567) and insurance companies

For tax year 2012, the annual return is due April 30, 2013.

(Form 4588).

All fiscal filers with a federal tax year end in 2012, must file

a short period return for MBT beginning on January 1, 2012

Filing if Tax Year Is Less Than 12 Months

and ending with the fiscal year end in 2012. Fiscal year filer’s

first short period return required under the MBT election is

Generally, annual returns must be filed for the same period as

extended to April 30, 2013.

federal income tax returns.

After that first required short period return, if you are a fiscal

Tax year means the calendar year, or the fiscal year ending

filer, the annual return is due on the last day of the fourth

during the calendar year, upon the basis of which the tax base

of a taxpayer is computed. If a return is made for a fractional

month after the end of the tax year.

part of a year, tax year means the period for which the return is

Additional Filing Time

made.

If additional time is needed to file an annual tax return, request

A taxpayer that has a 52- or 53-week tax year beginning not

a Michigan extension by filing an Application for Extension of

more than seven days before December 31 of any year is

Time to File Michigan Tax Returns (Form 4). Check the box for

considered to have a tax year beginning after December of that

MBT to extend the time to file an MBT return.

tax year.

Filing a federal extension request with the IRS does not

Example 1: A taxpayer with a federal tax year beginning on

automatically grant an MBT extension. The IRS does not

Monday, December 29, 2008, will be treated as follows:

notify state governments of extensions. A request for a

Michigan extension must be received and approved to avoid

• 2008 tax year end of December 31, 2008.

penalty on the tax due.

• Due date of April 30, 2009.

Extension applications must be postmarked on or before the

• 2009 tax year beginning January 1, 2009.

due date of an annual return.

Example 2: A taxpayer with a federal tax year ending on

Although Treasury may grant extensions for filing MBT

Sunday, January 3, 2010, will be treated as follows:

returns, it will not extend the time to pay. Extension

• 2009 tax year end of December 31, 2009.

applications received without proper payment will not be

processed. Penalty and interest will accrue on the unpaid tax

• Due date of April 30, 2010.

from the original due date of the return.

• 2010 tax year beginning on January 1, 2010.

Properly filed and paid estimates along with the amount

Example 3: A 52- or 53-week year closing near the end of

included on the extension application will be accepted as

January is common in the retail industry. Such a taxpayer will

payment on a tentative return, and an extension may be

be treated as follows:

granted. It is important that the application is completed

• 2008-09 fiscal year end will be January 31, 2009.

correctly.

• Due date will be May 31, 2009.

Once a properly prepared and timely filed application along

• 2009-10 fiscal year will begin on February 1, 2009.

with appropriate estimated tax payments is received, Treasury

8

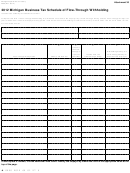

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42