following are straightforward, but take care to consider any

deductions, and activities separately by member, then combines

available refundable credits on Form 4590, Part 2.

those items as if the members were a single entity. References

in the instructions to “the taxpayer” generally will refer to the

Further General Guidance

group rather than any one of its members.

For purposes of MBT, person means an individual, firm, bank,

This is a simplification for introductory purposes, and there are

financial institution, insurance company, limited partnership,

many details and exceptions described throughout the MBT

limited liability partnership, copartnership, partnership, joint

forms and instructions. In particular, tax credits, transactions

venture, association, corporation, S corporation, LLC, receiver,

between members, and the presence of financial institutions or

estate, trust, or any other group or combination of groups

insurance companies in the group require careful attention.

acting as a unit.

One key issue in dealing properly with unitary taxation is to

A taxpayer includes a single person or a UBG liable for tax,

recognize that it is not limited to large, multi-state companies.

interest, or penalty. A UBG must file a combined MBT return

Businesses of any size and any geographic extent may find that

(addressed in the “UBGs and Combined Filing” section of this

they are members of a UBG.

General Information).

Limited Liability Company. An LLC is classified for MBT

Determining the Existence and Membership of a

purposes according to its federal tax classification. The

UBG

following terms, whenever used in MBT forms, instructions,

Unitary Business Group means a group of United States

and statute, include LLCs as indicated:

persons, other than a foreign operating entity, that satisfies the

S Corporation includes an LLC federally taxed as an S

control test and relationship test.

Corporation, and a member of this LLC is a shareholder.

United States person is defined in Internal Revenue Code (IRC)

C Corporation includes an LLC federally taxed as a C

§ 7701(a)(30). A foreign operating entity is defined by statute in

Corporation, and a member of this LLC is a shareholder. A

Michigan Compiled Laws (MCL) 208.1109(5).

member or other person performing duties similar to those of

Control Test. The control test is satisfied when one person

an officer in a true corporation is an officer in this LLC.

owns or controls, directly or indirectly, more than 50 percent

NOTE: In this booklet, the term “corporation,” used without a

of the ownership interest with voting or comparable rights of

C or S, generally refers to both types.

the other person or persons. A person owns or controls more

than 50 percent of the ownership interest with voting rights

NOTE: In general, a person that is a disregarded entity for

or ownership interest that confer comparable rights to voting

federal tax purposes, including a single member LLC or

rights of another person if that person owns or controls:

Q-Sub, must file as if it were a sole proprietorship if owned

by an individual, or a branch or division if owned by another

More than 50 percent of the total combined voting power of all

business entity.

ownership interests with voting (or comparable) rights, or

Fiduciaries filing for Trusts engaged in business activity must

More than 50 percent of the total value of all ownership

file an MBT return and report the total business activity.

interests with voting (or comparable) rights.

Relationship Tests. The definition of a UBG requires, in

UBGs and Combined Filing

addition to satisfying the control test, that the group of persons

NOTE: UBGs are addressed below, in general. In the

have business activities or operations that either:

instructions for each form, “Special Instructions for Unitary

Business Groups” are located directly before “Line-by-Line

1) Result in a flow of value between or among persons in the

Instructions.” The areas in the “Line-by-Line Instructions” that

group, or

apply only to UBGs are labeled “UBGs.” Additional direction

2) Are integrated with, dependent upon, or contribute to each

is found in the “Supplemental Instructions for Standard

other.

Members in UBGs.”

A taxpayer need only meet one of the two alternative tests to

General Overview of Unitary Taxation

satisfy the relationship test.

More than 20 states have adopted unitary taxation. Unitary

1) Flow of value is established when members of the group

taxation is a method of taxing related persons that, if it applies,

demonstrate one or more of functional integration, centralized

generally treats those related persons as if they were one.

management, and economies of scale. Examples of functional

There are specific tests, discussed below, to determine whether

integration include common programs or systems and shared

two or more persons (Individuals or business entities) are

information or property. Examples of centralized management

sufficiently connected by ownership and business relationships

include common management or directors, shared staff

to be treated as a group.

functions, and business decisions made for the UBG rather

If those tests are satisfied and a UBG is found to exist, in most

than separately by each member. Examples of economies

cases the members of that UBG will file a single MBT return.

of scale include centralized business functions and pooled

One member will be designated as the group’s representative

benefits or insurance. Groups that commonly exhibit a flow of

for filing the return and corresponding with Treasury. Included

value include vertically or horizontally integrated businesses,

in that return will be a separate form that reports income,

conglomerates, parent companies with their wholly owned

7

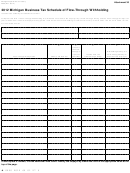

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42