VII. Acknowledgment and Agreement

Each of the undersigned specifically represents to Lender and Lender’s actual or potential agents, brokers, processors, attorneys, insurers, servicers, successors

and assigns and agrees and acknowledges that: (1) the information provided in this application is true and correct as of the date set forth opposite my signature and

that any intentional or negligent misrepresentation of this information contained in this application may result in civil liability, including monetary damages, to any

person who may suffer any loss due to reliance upon any misrepresentation that I have made on this application, and/or in criminal penalties including, but not limited

to, fine or imprisonment or both under the provisions of Title 18, United States Code, sec. 1001, et seq.; (2) the loan requested pursuant to this application (the

“Loan”) will be secured by a mortgage or deed of trust of the property described herein; (3) the property will not be used for any illegal or prohibited purpose or use;

(4) all statements made in this application are made for the purpose of obtaining a residential mortgage loan; (5) the property will be occupied as indicated herein; (6)

any owner or servicer of the Loan may verify or reverify any information contained in the application from any source named in this application, and Lender, its

successors or assigns may retain the original and/or an electronic record of this application, even if the Loan is not approved; (7) the Lender and its agents, brokers,

insurers, servicers, successors and assigns may continuously rely on the information contained in the application, and I am obligated to amend and/or supplement

the information provided in this application if any of the material facts that I have represented herein should change prior to closing of the Loan; (8) in the event that

my payments on the Loan become delinquent, the owner or servicer of the Loan may, in addition to any other rights and remedies that it may have relating to such

delinquency, report my name and account information to one or more consumer credit reporting agencies; (9) ownership of the Loan and/or administration of the

Loan account may be transferred with such notice as may be required by law; and (10) neither Lender nor its agents, brokers, insurers, servicers, successors or

assigns has made any representation or warranty, express or implied, to me regarding the property or the condition or value of the property.

Certification: I/We certify that the information provided in this application is true and correct as of the date set forth opposite my/our signature(s) on this application

and acknowledge my/our understanding that any intentional or negligent misrepresentation(s) of the information contained in this application may result in civil

liability and/or criminal penalties including, but not limited to, fine or imprisonment or both under the provisions of Title 18, United State Code, Section 1001, et seq.

and liability for monetary damages to the Lender, its agents, successors and assigns, insurers and any other person who may suffer any loss due to reliance upon

any misrepresentation which I/we have made on this application.

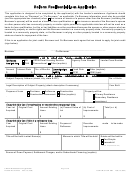

Borrower’s Signature

Date

Co-Borrower’s Signature

Date

X

X

VIII. Information for Government Monitoring Purposes

The following information is requested by the Federal Government for certain types of loans related to a dwelling in order to monitor the lender's

compliance with equal credit opportunity, fair housing and home mortgage disclosure laws. You are not required to furnish this information, but are

encouraged to do so. The law provides that a lender may discriminate neither on the basis of this information, nor on whether you choose to furnish

it. If you furnish the information, please provide both ethnicity and race. For race, you may check more than one designation. If you do not furnish

ethnicity, race, or sex, under Federal regulations, this lender is required to note the information on the basis of visual observation or surname. If you

do not wish to furnish the information, please check the box below. (Lender must review the above material to assure that the disclosures satisfy all

requirements to which the Lender is subject under applicable state law for the particular type of loan applied for.)

BORROWER

__ I do not wish to furnish this information.

CO-BORROWER

__ I do not wish to furnish this information.

Ethnicity:

__ Hispanic or Latino

__ Not Hispanic or Latino

Ethnicity:

__ Hispanic or Latino

__ Not Hispanic or Latino

Race:

__ American Indian or

__ Asian

__ Black or

Race:

__ American Indian or

__ Asian

__ Black or

Alaska Native

African American

Alaska Native

African American

__ Native Hawaiian or

__ Native Hawaiian or

__ White

__ White

Other Pacific Islander

Other Pacific Islander

Sex:

Sex:

__ Female

__ Male

__ Female

__ Male

Interviewer's Name (print or type)

Name and Address of Interviewer's Employer

TO BE COMPLETED BY INTERVIEWER

This application was taken by:

Interviewer's Signature

Date

___ Face-to face interview

___ Mail

Interviewer's Phone Number (include area code)

___ Telephone

NOTE: FHA insures reverse mortgages for one to four family units under various provisions of the National Housing Act. The information contained on the

loan application is collected to determine eligibility for the program as well as serve as verification of the applicant’s statements. The performance function of the

agency will be improved by collecting this data as determinations can be made regarding the characteristics of those borrowers obtaining HECM loans. The Public

Reporting Burden for this collection is estimated to average one hour per response, including time for reviewing instructions, searching existing data sources,

gathering and maintaining the data and completing and reviewing the collection of information. A response is required to obtain a HECM loan, but parties are not

required to use this particular form. This information is covered by the Privacy Act.

Fannie Mae Form 1009 05/2004

3

Page

of 4

1

1 2

2 3

3 4

4