Rsa 79-A:10 Land Use Change Tax Abatement Application To Municipality Page 2

ADVERTISEMENT

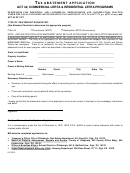

RSA 79-A:10 LAND USE CHANGE TAX ABATEMENT APPLICATION

SECTION A. Person(s) Applying (Owner(s)/Taxpayer(s))

Name:

Mailing Address:

Telephone Number: (Work)

(Home)

SECTION B. Representative if Other than Owner(s)/Taxpayer(s)

(Must Also Complete Section A)

Name:

Mailing Address:

Telephone Number: (Work)

(Home)

SECTION C. Property for Which Abatement is Sought

List the tax map and lot number and the actual street address of each property for which an

abatement is sought and include a brief description and the assessment. (Attach additional sheets

if needed.)

Tax Map & Lot

Address

Description

Assessment

SECTION D. LUCT Information

Change Date: __________ LUCT Amount: _________ Full value Assessment:

Event causing imposition of LUCT:

Change Date: __________ LUCT Amount: _________ Full value Assessment:

Event causing imposition of LUCT:

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4