Rsa 79-A:10 Land Use Change Tax Abatement Application To Municipality Page 3

ADVERTISEMENT

SECTION E. Comparable Properties

List the properties you are relying upon to show overassessment of the LUCT.

(Attach additional sheets if needed.)

Tax Map & Lot

Address

Description

Assessment

Attach a copy of the LUCT bill

SECTION F. LUCT Bill

.

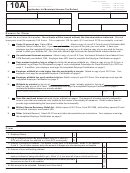

SECTION G. Reasons for Abatement Application

The Taxpayer has the burden to prove the LUCT was improperly assessed or was excessive.

Therefore, state with specificity the grounds for the abatement request with sufficient specificity

to allow the Municipality to understand the Taxpayer's arguments and to allow the Municipality

the opportunity to review and address the Taxpayer's concerns. Specificity could include

statements such as: (1) the Municipality erred in removing the land from current use and thereby

imposing any LUCT; (2) the LUCT was excessive compared to the property's value on the

change use date; or (3) the Municipality used an incorrect change use date, resulting in an

excessive LUCT. (Attach additional sheets if needed.)

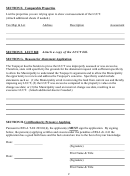

SECTION H. Certification by Person(s) Applying

Pursuant to BTLA TAX 203.02(d), the applicant(s) MUST sign the application. By signing

below, the person(s) applying certifies and swears under the penalties of RSA ch. 641 the

application has a good faith basis and the facts stated are true to the best of my/our knowledge.

Date:

(Signature)

____________________________________

Print Name & Title

Date:

(Signature)

Print Name & Title

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4