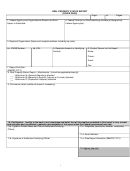

Real Property Status Report (Cover Page) Page 7

ADVERTISEMENT

B. Instructions Related to Attachment A (General Reporting) follows:

Real Property Details. Provide the requested information in subsections 13 through 17 of attachment A for each parcel

of real property being reported. Use a separate sheet to report information on each parcel of real property under the

Federal financial assistance award identified in section 2. If a section does not apply, enter “N/A.” Below is a summary

of the required information to be provided for each subsection of attachment A:

13. Period of Federal Interest. Enter the period, established in the award document, during which Federal interest in

the real property begins (i.e., From) and ends (i.e., To) using (MM/DD/YYYY) format. [ex., From: 03/23/2005 To:

03/22/2025]. This period may exceed the grant award performance period in those instances where Federal interest

continues beyond the end of the current award. In some instances the end date for the period of Federal interest may

not be defined by a specific date. If that is the case, enter the beginning date along with a statement to indicate the

planned or uncertain end date (ex. “From: 03/23/2005 To: Expiration of Federal Interest”).

14a. Description of Real Property. Describe the type of real property being reported (i.e., land, building, etc.) and

provide a useful description of the real property (i.e., building number 17 at the National Research Center, Chapel Hill,

NC). If the real property is being renovated or altered, also describe the nature of the work (i.e. major renovation of

building 17, wing c).

14b. Address of Real Property. Enter the legal description and complete address for each parcel of real property being

reported including the street, city, state, county/parish, country, zip code, and physical location if an address is not

available (i.e., latitude, longitude, lot number, parcel number, etc.). Also, indicate zoning information related to the real

property (i.e., mixed use, residential, commercial, etc.). Where an address is not available, or more precision is required,

geographic coordinates may be used. Locational data should be recorded with a Global Positioning System (GPS)

device set to NAD 83, or WGS 84 datum using either of the following coordinate reference systems:

•

United States National Grid (USNG) using the full grid zone designation and a minimum of eight

digits.

•

Decimal degrees latitude and longitude, with at least 6 decimal places and a minus (-) to show

west longitude or south latitude.

14c. Acreage. Enter the size of the land or the size of the land on which the real property is located in terms of

measured acreage (i.e., 1.5 acres, etc.).

14d. Gross Square Meters and Usable Square Meters (i.e., of building, house, etc.). Enter the gross and usable

square meters for each structure (i.e., of the building, house, etc.) being reported.

14e. Real Property Ownership Type. Check the applicable box to indicate the real property ownership type. If the

ownership types listed do not apply, check “I. Other” and describe the ownership arrangement. Example of Other:

Conservation Easement.

14f. Beginning Date of Federal Interest Using (MM/DD/YYYY) format, enter the date when the Federal Interest relating

to this specific award began on the real property being reported. Check the appropriate box indicating the action the

Interest is tied to. Federal Agencies will define the applicable beginning date.

14g. Real Property Cost. Enter the total cost of the real property acquired (purchase price only) or improved, including

the following data. If multiple Federal agencies are contributing to the acquisition or improvement of the real property,

attach a separate sheet to identify each agency and their contribution using the format below:

1. Amount provided by the Federal government (i.e., Federal Share of Property Cost based on the Federal share of

the total cost of the program or project),

2. Share percentage provided by the Federal government (i.e., Federal Share Percentage of Property Cost based

on the Federal share of the total cost of the program or project),

3. Amount provided by the recipient or other non-Federal entities (i.e., non-Federal Share of Property Cost),

4. Share percentage provided by the non-Federal entities, (i.e., non-Federal Share Percentage of Property Cost),

5. Total cost (i.e., Sum of Federal and non-Federal Share of the Property Cost), and

vii

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13