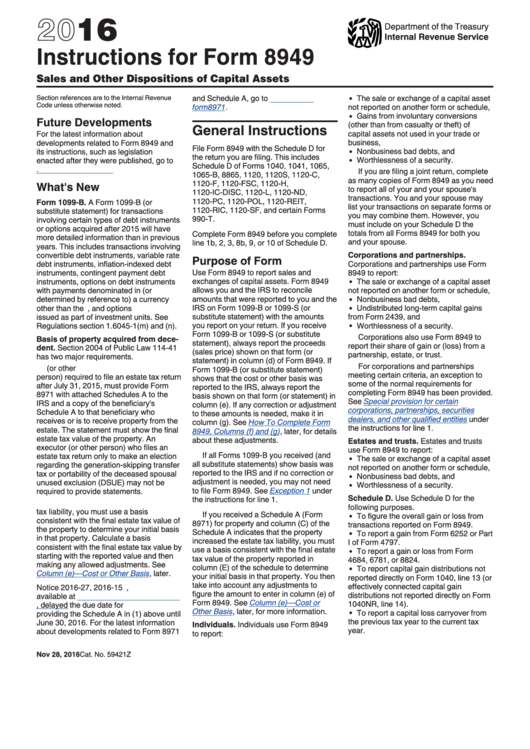

Instructions For Form 8949 - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 8949

Sales and Other Dispositions of Capital Assets

and Schedule A, go to

The sale or exchange of a capital asset

Section references are to the Internal Revenue

Code unless otherwise noted.

form8971.

not reported on another form or schedule,

Gains from involuntary conversions

Future Developments

(other than from casualty or theft) of

General Instructions

capital assets not used in your trade or

For the latest information about

developments related to Form 8949 and

business,

File Form 8949 with the Schedule D for

Nonbusiness bad debts, and

its instructions, such as legislation

the return you are filing. This includes

Worthlessness of a security.

enacted after they were published, go to

Schedule D of Forms 1040, 1041, 1065,

form8949.

If you are filing a joint return, complete

1065-B, 8865, 1120, 1120S, 1120-C,

as many copies of Form 8949 as you need

1120-F, 1120-FSC, 1120-H,

What's New

to report all of your and your spouse's

1120-IC-DISC, 1120-L, 1120-ND,

transactions. You and your spouse may

1120-PC, 1120-POL, 1120-REIT,

Form 1099-B. A Form 1099-B (or

list your transactions on separate forms or

1120-RIC, 1120-SF, and certain Forms

substitute statement) for transactions

you may combine them. However, you

990-T.

involving certain types of debt instruments

must include on your Schedule D the

or options acquired after 2015 will have

totals from all Forms 8949 for both you

Complete Form 8949 before you complete

more detailed information than in previous

and your spouse.

line 1b, 2, 3, 8b, 9, or 10 of Schedule D.

years. This includes transactions involving

convertible debt instruments, variable rate

Corporations and partnerships.

Purpose of Form

debt instruments, inflation-indexed debt

Corporations and partnerships use Form

Use Form 8949 to report sales and

instruments, contingent payment debt

8949 to report:

exchanges of capital assets. Form 8949

The sale or exchange of a capital asset

instruments, options on debt instruments

with payments denominated in (or

allows you and the IRS to reconcile

not reported on another form or schedule,

amounts that were reported to you and the

determined by reference to) a currency

Nonbusiness bad debts,

IRS on Form 1099-B or 1099-S (or

other than the U.S. dollar, and options

Undistributed long-term capital gains

substitute statement) with the amounts

issued as part of investment units. See

from Form 2439, and

you report on your return. If you receive

Regulations section 1.6045-1(m) and (n).

Worthlessness of a security.

Form 1099-B or 1099-S (or substitute

Corporations also use Form 8949 to

Basis of property acquired from dece-

statement), always report the proceeds

report their share of gain or (loss) from a

dent. Section 2004 of Public Law 114-41

(sales price) shown on that form (or

partnership, estate, or trust.

has two major requirements.

statement) in column (d) of Form 8949. If

For corporations and partnerships

1. An executor of an estate (or other

Form 1099-B (or substitute statement)

meeting certain criteria, an exception to

person) required to file an estate tax return

shows that the cost or other basis was

some of the normal requirements for

after July 31, 2015, must provide Form

reported to the IRS, always report the

completing Form 8949 has been provided.

8971 with attached Schedules A to the

basis shown on that form (or statement) in

See

Special provision for certain

IRS and a copy of the beneficiary's

column (e). If any correction or adjustment

corporations, partnerships, securities

Schedule A to that beneficiary who

to these amounts is needed, make it in

dealers, and other qualified entities

under

receives or is to receive property from the

column (g). See

How To Complete Form

the instructions for line 1.

estate. The statement must show the final

8949, Columns (f) and

(g), later, for details

estate tax value of the property. An

about these adjustments.

Estates and trusts. Estates and trusts

executor (or other person) who files an

use Form 8949 to report:

If all Forms 1099-B you received (and

estate tax return only to make an election

The sale or exchange of a capital asset

all substitute statements) show basis was

regarding the generation-skipping transfer

not reported on another form or schedule,

reported to the IRS and if no correction or

tax or portability of the deceased spousal

Nonbusiness bad debts, and

adjustment is needed, you may not need

unused exclusion (DSUE) may not be

Worthlessness of a security.

to file Form 8949. See

Exception 1

under

required to provide statements.

Schedule D. Use Schedule D for the

the instructions for line 1.

2. If the property increases the estate

following purposes.

tax liability, you must use a basis

If you received a Schedule A (Form

To figure the overall gain or loss from

consistent with the final estate tax value of

8971) for property and column (C) of the

transactions reported on Form 8949.

the property to determine your initial basis

Schedule A indicates that the property

To report a gain from Form 6252 or Part

in that property. Calculate a basis

increased the estate tax liability, you must

I of Form 4797.

consistent with the final estate tax value by

use a basis consistent with the final estate

To report a gain or loss from Form

starting with the reported value and then

tax value of the property reported in

4684, 6781, or 8824.

making any allowed adjustments. See

column (E) of the schedule to determine

To report capital gain distributions not

Column (e)—Cost or Other

Basis, later.

your initial basis in that property. You then

reported directly on Form 1040, line 13 (or

take into account any adjustments to

effectively connected capital gain

Notice 2016-27, 2016-15 I.R.B. 576,

figure the amount to enter in column (e) of

distributions not reported directly on Form

available at

irb/2016-15_IRB/

Form 8949. See

Column (e)—Cost or

1040NR, line 14).

ar09.html, delayed the due date for

Other

Basis, later, for more information.

To report a capital loss carryover from

providing the Schedule A in (1) above until

the previous tax year to the current tax

June 30, 2016. For the latest information

Individuals. Individuals use Form 8949

year.

about developments related to Form 8971

to report:

Nov 28, 2016

Cat. No. 59421Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10