Affidavit as Proof of Eligibility for Residential Homestead Exemption Instructions

•General Residence Homestead Exemptions: You may only apply

•Surviving Spouse Extensions:

for residence homestead exemptions on one property in a tax year. A

Age 65 or older – You qualify for an extension of this exemption if

homestead exemption may include up to 20 acres of land that you

(1) you are 55 years of age or older on the date your spouse died and

actually use in the residential use (occupancy) of your home. Arbitrary

(2) your deceased spouse was receiving the over-65 exemption on

factors that are unrelated to that use, such as acreage limits,

this residence homestead or would have applied and qualified for the

matching legal descriptions, and contiguous parcels, may not be

exemption in the year of the spouse’s death.

considered in determining if the land qualifies. To qualify for a

homestead exemption, you must own and reside in your home on

Disabled: You will not qualify for a disability exemption claimed by

January 1 of the tax year. If you temporarily move away from your

your deceased spouse. You are not entitled to continue the school

home, you still can qualify for an exemption if you don’t establish

tax limitation; however, you will be entitled to continue the local option

another principal residence and you intend to return in a period of less

county, city or junior college limitation. 100% Disabled Veteran. You

than two (2) years. Homeowners in military service outside the U.S. or

qualify for an extension of this exemption if, at the time of the

in a facility providing services related to health, infirmity, or aging may

veteran's death, you were married and this property was your

exceed the two-year period.

residence. If you re-marry, the exemption ends.

•Over-65 or Disability Exemptions: You may receive an over-65 or

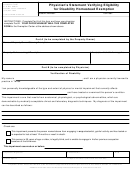

Owner’s Name and Address.

disability homestead exemption immediately upon qualification for the

A. Print your name clearly under Owner's Name.

exemption. If you have not provided your birth date on this application,

B. Print your current mailing address.

you must apply before the first anniversary of your qualification date to

C. Write your Texas driver's license number or Texas

receive the exemption in that tax year. For example, if you turn 65 or

state-issued ID card number in the box. IMPORTANT -

are disabled on June 1 of the current year, you have until May 31 of

Attach a copy of your driver's license or state-issued

the next year to apply for the current tax year’s over-65 or disability

personal identification certificate. The address listed on

exemption. This special provision only applies to an over-65 or

your driver's license or state-issued personal identification

disability exemption and not to other exemptions for which you may

certificate must correspond to the address of the property

apply.

for which an exemption is claimed in this application. In

certain cases, you are exempt from these requirements or

Disability Exemptions. You are entitled to the exemption if you meet

the chief appraiser may waive the requirements.

the Social Security Administration's tests for disability. In simplest

terms:

D. Complete all information requested on the affidavit.

1) You must have a medically determinable physical or mental

impairment;

Describe the property.

2) The impairment must prevent you from engaging in any

Enter the information requested. Enter the number of acres used for

substantial gainful activity; and

residential purposes.

If you are applying for a residential

3) The impairment must be expected to last for at least 12

homestead exemption for a manufactured home, you must

continuous months or to result in death.

complete page 3.

Alternatively, you will qualify if you are 55 or older and blind and

Check exemptions that apply to you.

cannot engage in your previous work because of your blindness.

Complete by checking the boxes that apply. If you check the disability

exemption, attach documents verifying your disability. If a surviving

To verify your eligibility, attach a copy of your disability determination

spouse, enter all information requested.

letter from Social Security (or other recognized retirement system), or

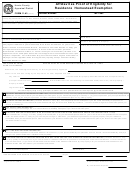

have your physician complete and mail us the HCAD form titled

Execute this affidavit before a Notary Public or other

Physician's

Statement

Verifying

Eligibility

for

Disability

official authorized to administer oaths.

Making

false

Homestead Exemption.

statements on your exemption application is a criminal offense.

•Tax Limitations: The over-65 or disability exemption for school

taxes includes a school tax limitation, or ceiling. Other types of taxing

units – county, city, or junior college – have the option to grant a tax

limitation on homesteads of homeowners who are disabled or 65

years of age or older.

•100% Disabled Veterans: Certain disabled veterans are eligible for

100%

exemptions

for

their

residence

homesteads.

Current

documentation from the Department of Veterans Affairs (VA) must be

submitted to prove that the veteran receives full VA compensation and

is either rated at 100% disabled or has a determination of

unemployability from the VA. If you qualify for this exemption after

Jan. 1 of the tax year you may receive the exemption for the portion of

the year for which you qualify.

To obtain a list of taxing units and the exemptions each taxing unit offers, visit or call (713) 957-7800.

11.43 (10/2013)

Page 2

1

1 2

2 3

3 4

4