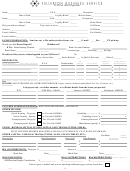

Tax Organizer Template - 2008 Page 3

ADVERTISEMENT

Cash/Check/Credit Contributions

Amount

Miscellaneous Deductions

Amount

Union and professional dues

Professional subscriptions, books, supplies

Uniforms and protective clothing (including cleaning)

Job search costs

Taxpayer educator expenses

Spouse educator expenses

Tax return preparation fees

Safe deposit box rental

Gambling losses (to the extent of gambling income)

Other expenses (list):

Yes

No

1. Have you deffered a Roth IRA Conversation in the past 3 years?

2. Did a lender cancel any of your debt in 2012? (attach any form 1099-A or 1099-C)

?

3. Did you purchase a motor vehicle or boat ?

4. Did you change your marital status?

If yes, explain:

5. Do you have dependents who must file?

6. Do you have children who are under 19 or a full time student under age 24 with

investment income greater than $1900?

7. Did you receive a total distribution from an IRA or other qualified plan that was

partially or totally rolled over into another IRA or qualified plan with 60 days of

the distribution?

8. a. Did you buy, sell, refinance, foreclose or abandon a principal residence or

other real property? If yes, attach closing or escrow statements,

1099-C or 1099-A forms.

b. If you sold a home, did you claim the First-Time Homebuyer Credit when

you purchased it? Are you paying installments for 2008 $7500 tax credit ?

9. Did you incur any moving expenses? If yes, attach details

10. Did you or your spouse elect continuation of COBRA coverage after your

employment was involuntary terminated?

11. Did you receive any income not included in this Tax Organizer? If yes, please

attach information.

12. If you paid any alimony, enter recipient's SSN:

Alimony paid:

13. Enter your state of residence

Estimated Tax Payments

Date

Amount

Additional Information (enter any additional information here and attach any documents)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3