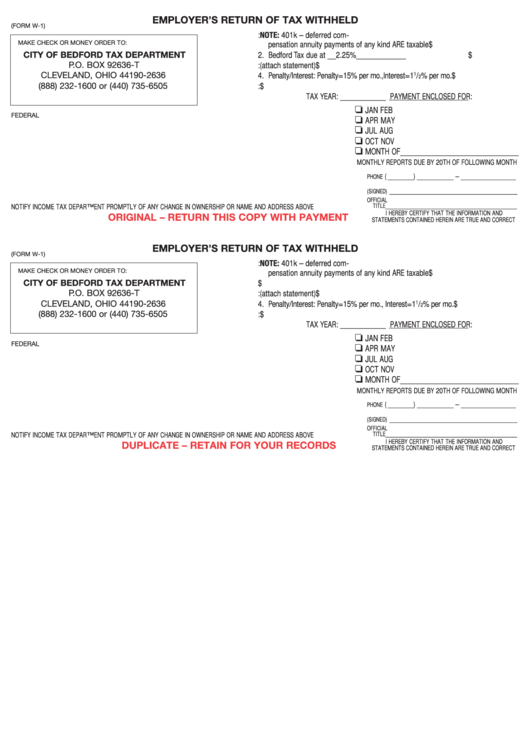

Form W-1 - Employer'S Return Of Tax Withheld

ADVERTISEMENT

EMPLOYER’S RETURN OF TAX WITHHELD

(FORM W-1)

1. Payroll subject to Bedford Tax: NOTE: 401k – deferred com-

MAKE CHECK OR MONEY ORDER TO:

pensation annuity payments of any kind ARE taxable

$ .........................

CITY OF BEDFORD TAX DEPARTMENT

2. Bedford Tax due at __2.25%____________

$ .........................

P.O. BOX 92636-T

3. Adjustments to tax: (attach statement)

$ .........................

CLEVELAND, OHIO 44190-2636

1

4. Penalty/Interest: Penalty=15% per mo., Interest =1

/

% per mo. $ .........................

2

(888) 232-1600 or (440) 735-6505

5. TOTAL DUE WITH THIS FORM:

$ .........................

TAX YEAR: ___________ PAYMENT ENCLOSED FOR:

JAN FEB MAR.................................... DUE 4/30

FEDERAL I.D./SSN

APR MAY JUNE .................................. DUE 7/31

JUL AUG SEPT ................................. DUE 10/31

OCT NOV DEC.................................... DUE 1/31

MONTH OF___________________________

MONTHLY REPORTS DUE BY 20TH OF FOLLOWING MONTH

( _______ ) __________ – _______________

PHONE

___________________________________

(SIGNED)

OFFICIAL

____________________________________

TITLE

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS ABOVE

I HEREBY CERTIFY THAT THE INFORMATION AND

ORIGINAL – RETURN THIS COPY WITH PAYMENT

STATEMENTS CONTAINED HEREIN ARE TRUE AND CORRECT

EMPLOYER’S RETURN OF TAX WITHHELD

(FORM W-1)

1. Payroll subject to Bedford Tax: NOTE: 401k – deferred com-

MAKE CHECK OR MONEY ORDER TO:

pensation annuity payments of any kind ARE taxable

$ .........................

CITY OF BEDFORD TAX DEPARTMENT

2. Bedford Tax due at ______________

$ .........................

P.O. BOX 92636-T

3. Adjustments to tax: (attach statement)

$ .........................

CLEVELAND, OHIO 44190-2636

1

4. Penalty/Interest: Penalty=15% per mo., Interest =1

/

% per mo. $ .........................

2

(888) 232-1600 or (440) 735-6505

5. TOTAL DUE WITH THIS FORM:

$ .........................

TAX YEAR: ___________ PAYMENT ENCLOSED FOR:

JAN FEB MAR.................................... DUE 4/30

FEDERAL I.D./SSN

APR MAY JUNE .................................. DUE 7/31

JUL AUG SEPT ................................. DUE 10/31

OCT NOV DEC.................................... DUE 1/31

MONTH OF___________________________

MONTHLY REPORTS DUE BY 20TH OF FOLLOWING MONTH

( _______ ) __________ – _______________

PHONE

___________________________________

(SIGNED)

OFFICIAL

____________________________________

TITLE

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS ABOVE

I HEREBY CERTIFY THAT THE INFORMATION AND

DUPLICATE – RETAIN FOR YOUR RECORDS

STATEMENTS CONTAINED HEREIN ARE TRUE AND CORRECT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1