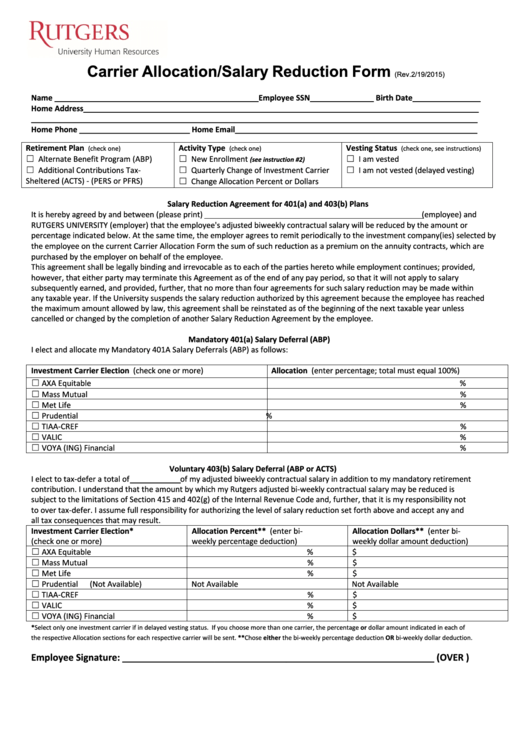

Carrier Allocation/Salary Reduction Form

(Rev.2/19/2015)

Name ________________________________________________Employee SSN_______________ Birth Date________________

Home Address_____________________________________________________________________________________________

_________________________________________________________________________________________________________

Home Phone __________________________ Home Email_________________________________________________________

Retirement Plan

Activity Type

Vesting Status

(check one)

(check one)

(check one, see instructions)

☐ Alternate Benefit Program (ABP)

☐ New Enrollment

☐ I am vested

(see instruction #2)

☐ Additional Contributions Tax‐

☐ Quarterly Change of Investment Carrier

☐ I am not vested (delayed vesting)

Sheltered (ACTS) ‐ (PERS or PFRS)

☐ Change Allocation Percent or Dollars

Salary Reduction Agreement for 401(a) and 403(b) Plans

It is hereby agreed by and between (please print)

(employee) and

RUTGERS UNIVERSITY (employer) that the employee's adjusted biweekly contractual salary will be reduced by the amount or

percentage indicated below. At the same time, the employer agrees to remit periodically to the investment company(ies) selected by

the employee on the current Carrier Allocation Form the sum of such reduction as a premium on the annuity contracts, which are

purchased by the employer on behalf of the employee.

This agreement shall be legally binding and irrevocable as to each of the parties hereto while employment continues; provided,

however, that either party may terminate this Agreement as of the end of any pay period, so that it will not apply to salary

subsequently earned, and provided, further, that no more than four agreements for such salary reduction may be made within

any taxable year. If the University suspends the salary reduction authorized by this agreement because the employee has reached

the maximum amount allowed by law, this agreement shall be reinstated as of the beginning of the next taxable year unless

cancelled or changed by the completion of another Salary Reduction Agreement by the employee.

Mandatory 401(a) Salary Deferral (ABP)

I elect and allocate my Mandatory 401A Salary Deferrals (ABP) as follows:

Investment Carrier Election (check one or more)

Allocation (enter percentage; total must equal 100%)

☐ AXA Equitable

%

☐ Mass Mutual

%

☐ Met Life

%

☐ Prudential

%

☐ TIAA‐CREF

%

☐ VALIC

%

☐ VOYA (ING) Financial

%

Voluntary 403(b) Salary Deferral (ABP or ACTS)

I elect to tax‐defer a total of

of my adjusted biweekly contractual salary in addition to my mandatory retirement

contribution. I understand that the amount by which my Rutgers adjusted bi‐weekly contractual salary may be reduced is

subject to the limitations of Section 415 and 402(g) of the Internal Revenue Code and, further, that it is my responsibility not

to over tax‐defer. I assume full responsibility for authorizing the level of salary reduction set forth above and accept any and

all tax consequences that may result.

Investment Carrier Election*

Allocation Percent** (enter bi‐

Allocation Dollars** (enter bi‐

(check one or more)

weekly percentage deduction)

weekly dollar amount deduction)

☐ AXA Equitable

%

$

☐ Mass Mutual

%

$

☐ Met Life

%

$

☐ Prudential (Not Available)

Not Available

Not Available

☐ TIAA‐CREF

%

$

☐ VALIC

%

$

☐ VOYA (ING) Financial

%

$

*Select only one investment carrier if in delayed vesting status. If you choose more than one carrier, the percentage or dollar amount indicated in each of

the respective Allocation sections for each respective carrier will be sent. **Chose either the bi‐weekly percentage deduction OR bi‐weekly dollar deduction.

Employee Signature: _____________________________________________________________ (OVER )

1

1 2

2