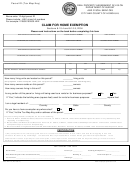

HOME EXEMPTION

You are entitled to the home exemption if the following requirements are met:

1.

The property is owned and occupied as your principal home more than 200 calendar days of a calendar year. The term "principal

home" is defined as the place where an individual has a true, fixed, permanent home and principal establishment and to which place

the individual has whenever absent, the intention of returning. It is the place in which a person has voluntarily fixed habitation, not for

mere special, temporary or vacation purposes, but with the intention of making a permanent home.

The ownership is recorded at the Bureau of Conveyances or Land Court in Honolulu on or before December 31 preceding the tax year

2.

for which the exemption is claimed or by June 30. All leases must be for a term of ten years or more and recorded at the Bureau of

Conveyances in order for the lessee to qualify for the home exemption. In the case of Hawaiian Homestead Land, either lessee and/or

spouse shall be entitled to the home exemption. Proof of marriage must be submitted for the non-Hawaiian spouse claiming the home

exemption.

You file a claim for home exemption, RP Form 19-71, with the Real Property Tax Division on or before December 31 preceding the tax

3.

year for the first half payment or June 30 for the second half payment.

4.

You have filed a State of Hawai‘i Resident Income Tax Return (N-11 or N-13) within the last 12 months or have requested a waiver

from this requirement for one of the following reasons: You are a new resident to the State of Hawai‘i and will file a State of Hawai‘i

Resident Income Tax Return (N-11 or N-13) within the next 12 months or You are not required to file under State of Hawai‘i Income

Tax Law and not required to file income tax in any other jurisdiction other than at the U.S. Federal level and understand that you are

required to refile this waiver every three (3) years. The social security number and date of birth as provided will be used to confirm

compliance with this requirement. Failure to provide this information will result in the disqualification of this application and the

benefits of the home exemption.

INSTRUCTIONS

1.

Fill in the tax map key/parcel ID of your property.

2.

Complete the claim form and submit a photocopy of your proof of age. Acceptable proof includes driver’s

license, state identification, birth certificate, or other government or legal document.

3.

Claim forms are available at the Real Property Tax Division Hilo Office, Kona Office, or the website at

4.

Deliver or mail the claim form with supporting documentation to:

Real Property Tax Division

Real Property Tax Division

Aupuni Center

West Hawai'i Civic Center

745044 Ane Keohokalole Hwy Bldg. D 2nd Flr.

101 Pauahi Street, Suite No. 4

KailuaKona, HI 96740

Hilo, HI 96720

Telephone: (808) 3234880

Telephone: (808) 9618201

SOCIAL SECURITY NUMBER

The social security number is required for the purpose of verifying the identity of the claimant, spouse, and State of Hawai‘i Resident

Income Tax Return filing status as required by Chapter 19-71(e)(1)(D), of the Hawai‘i County Code as revised. The requirement is

authorized under the Federal Social Security Act (42 U.S.C.A. Sec. 405 (c)(2)(C)). Disclosure is for the purpose of this exemption and

social security numbers will not be subject to public access. Failure to provide the last four digits of all applicant's social security

numbers will result in the disqualification of the Homeowner's Exemption benefit.

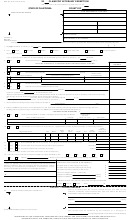

PLOT PLAN

Draw a plot plan if there is more than one dwelling unit on the property. Please show the dwelling location along with date built,

approximate size, one or two story, and adjacent roadway. Designate which building is your residence, the relationship of the

occupants of the other dwelling(s) and if it is rented.

1

1 2

2