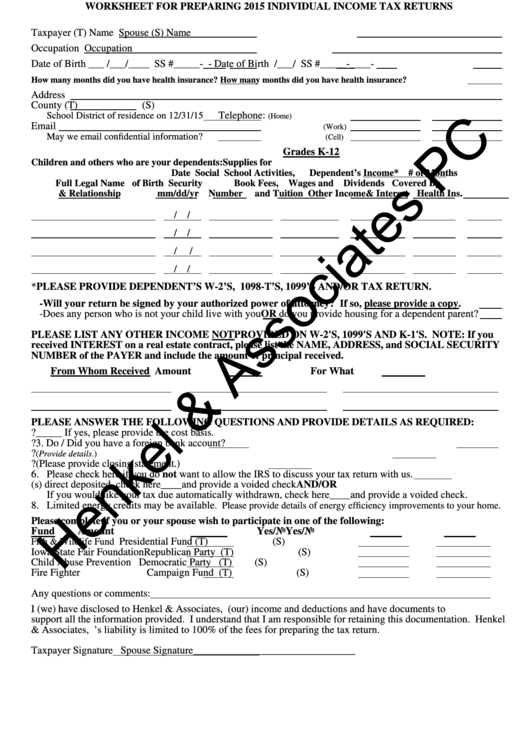

WORKSHEET FOR PREPARING 2015 INDIVIDUAL INCOME TAX RETURNS

Taxpayer (T) Name

Spouse (S) Name

Occupation

Occupation

Date of Birth ___ /___/____ SS #_____-

-

Date of Birth

/___/

SS #_____-____-

How many months did you have health insurance?

How many months did you have health insurance?

Address

County

(T)

(S)

Telephone:

School District of residence on 12/31/15

(Home)

Email

(Work)

May we email confidential information?

(Cell)

Grades K-12

Children and others who are your dependents:

Supplies for

Date

Social

School Activities,

Dependent’s Income* # of Months

Full Legal Name

of Birth

Security

Book Fees,

Wages and

Dividends Covered By

& Relationship

mm/dd/yr

Number

and Tuition

Other Income & Interest Health Ins.

/ /

/ /

/ /

/ /

*PLEASE PROVIDE DEPENDENT’S W-2’S, 1098-T’S, 1099’S AND/OR TAX RETURN.

-Will your return be signed by your authorized power of attorney? If so, please provide a copy.

-Does any person who is not your child live with you OR do you provide housing for a dependent parent?

PLEASE LIST ANY OTHER INCOME NOT PROVIDED ON W-2'S, 1099'S AND K-1'S. NOTE: If you

received INTEREST on a real estate contract, please list the NAME, ADDRESS, and SOCIAL SECURITY

NUMBER of the PAYER and include the amount of principal received.

From Whom Received

Amount

For What

PLEASE ANSWER THE FOLLOWING QUESTIONS AND PROVIDE DETAILS AS REQUIRED:

1. Did you have stock or mutual fund sales during the year?_____ If yes, please provide the cost basis.

2. Are you or your spouse legally blind?

3. Do / Did you have a foreign bank account?

4. Did you convert a regular IRA to a Roth IRA or recharacterize a Roth conversion?

(Provide details.)

5. Did you buy or sell your residence during this year?

(Please provide closing statement.)

6. Please check here if you do not want to allow the IRS to discuss your tax return with us.

7. If you would like your refund(s) direct deposited, check here____and provide a voided check AND/OR

If you would like your tax due automatically withdrawn, check here____and provide a voided check.

8. Limited energy credits may be available

. Please provide details of energy efficiency improvements to your home.

Please complete if you or your spouse wish to participate in one of the following:

Fund

Amount

Yes/No

Yes/No

Presidential Fund

(T)

(S)

Fish & Wildlife Fund

Iowa State Fair Foundation

Republican Party

(T)

(S)

Child Abuse Prevention

Democratic Party

(T)

(S)

Fire Fighter Prepare.Fund/Veterans Trust

Campaign Fund

(T)

(S)

Any questions or comments:

I (we) have disclosed to Henkel & Associates, P.C. all of my (our) income and deductions and have documents to

support all the information provided. I understand that I am responsible for retaining this documentation. Henkel

& Associates, P.C.’s liability is limited to 100% of the fees for preparing the tax return.

Taxpayer Signature

Spouse Signature_______________________________

1

1