Form 10a100 - Kentucky Tax Registration Application Page 2

ADVERTISEMENT

Page 2

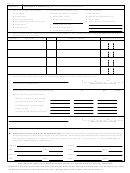

SECTION 2

Complete if applying for an Employer’s Withholding Account Number

1. Total number of persons

4. Mailing address for withholding returns

expected to be employed yearly

Mail to

(Note: See instructions on

withholding for corporate officers.)

Street address or post office box or route number

2. Date wages first paid to

__ __ / __ __ / __ __

employees in Kentucky

Mo.

Day

Yr.

City

State

ZIP Code

3. Estimated quarterly

withholding

$

County

Telephone (include area code)

SECTION 3

To be completed by all corporations

7. Mailing address for corporation income and license tax

__ __ / __ __ __ __

1. Date of incorporation

returns

Mo.

Year

Mail to

2. State of incorporation

3. If not incorporated in Kentucky,

list date registered to do business

Street address or post office box or route number

__ __ / __ __ __ __

in Kentucky

Mo.

Year

4. Is the corporation exempt from federal income taxation

City

State

ZIP Code

under Section 501 of the Internal Revenue Code?

Yes

No

County

Telephone (include area code)

If “Yes,” attach a copy of the determination letter issued by

the IRS and do not complete the remaining questions in

8. Does the corporation have separate divisions which

this section. Go to the next applicable section.

operate under the corporate authority?

Yes

No

5. Is the corporation a member of an affiliated corporate

group? (see instructions)

9. Has the corporation elected to be taxed as an S corporation

Yes

No

as defined in Section 1361(a) of the 1993 Internal Revenue

Code?

If “Yes,” please state the name and address of the

Yes

No

corporation

which

files

federal

Form

1120,

U.S.

10. Does the corporation:

Corporation Income Tax Return, for the affiliated group.

a. Own or lease any real or tangible

property in Kentucky?

Yes

No

Legal corporate name

b. Have any employees that work in

Kentucky?

Yes

No

DBA name (if any)

c.

Conduct any business in Kentucky?

Yes

No

d. Make any sales of tangible

personal property in Kentucky?

Yes

No

e. Have any employees outside

6. Does the corporation have interest in any partnership

Kentucky?

Yes

No

conducting business in Kentucky? (attach separate listing)

f.

Own or lease any real or tangible

Yes

No

property outside Kentucky?

Yes

No

SECTION 4

Complete if applying for Coal Severance and Processing Tax Registration

3. Mailing address for coal tax return

1.

Do you mine coal that you own or possess the mineral

rights to either by deed, lease, consent, etc.? (see

Mail to

instructions)

Yes

No

If leased, from whom?

Name

Street address or post office box or route number

Address

City

State

ZIP Code

2.

Do you employ others (contract miners) to mine your coal?

City

State

ZIP Code

(see instructions)

Yes

No

County

Telephone (include area code)

If “Yes,” attach separate schedule giving the name and

address of each contract miner.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4