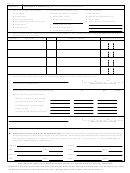

Form 10a100 - Kentucky Tax Registration Application Page 3

ADVERTISEMENT

Page 3

FOR CABINET USE ONLY

WH

CORP

COAL

SU

SU

BUS

BUS

BUS

BUS

__

__

__

A

B

C

SECTION 4

Complete if applying for Coal Severance and Processing Tax Registration (Continued)

4. Do you operate only as a contract miner, mining coal

9. List in the table below the information requested on each

belonging to others? (see instructions)

mine operated. Attach separate list if necessary.

Yes

No

10. Are you entitled to the depletion allowance under Section

If “Yes,” for whom?

611 of the Internal Revenue Code?

Yes

No

If “No,” who is entitled to the depletion allowance?

Name

Address

Name

City

State

ZIP Code

Address

5. Do you operate a tipple or processing plant?

City

State

ZIP Code

Yes

No

If “Yes,” give location(s). Attach separate schedule if

11. Do you own or operate any other coal mining, coal

additional space is needed.

processing (tipple, etc.), or coal brokerage company?

Yes

No

If “Yes,” list name and address.

Name

6. Do you purchase coal for the purpose of processing

Address

(cleaning, breaking, sizing, dust allaying, treating to

prevent freezing or loading for shipment) and resale?

City

State

ZIP Code

Yes

No

12. List name(s) and address(es) of persons to whom you sell

7. Do you purchase coal solely for the purpose of resale with

coal. Attach separate schedule if necessary.

no processing involved?

Yes

No

8. If the answer to question 1 under this section is “Yes,” do

Name

you also operate as a contract miner, mining coal

Address

belonging to others?

Yes

No

If “Yes,” for whom?

City

State

ZIP Code

13. Date mining or processing operation began or will begin.

Name

Address

__ __ / __ __ / __ __

Mo.

Day

Yr.

City

State

ZIP Code

Mine

Surface Disturbance

Kentucky Department of Mines

MSHA

Location

Name

Mining Permit Number

and Minerals File Number

Identification Number

(County)

15–

15–

15–

15–

SECTION 5

Complete if applying for (check one) :

Sales and Use Tax Permit or

Consumer Registration Number

5. Mailing address for sales and use tax returns

1. Give the date that sales or purchases of tangible personal

property began or will begin in Kentucky.

Mail to

__ __ / __ __ / __ __

Mo.

Day

Yr.

2. Check accounting method to be used in reporting total

Street address or post office box or route number

receipts.

Cash

Accrual

3. If you have more than one business location, do you wish

to file a consolidated return for all locations or a separate

City

State

ZIP Code

return for each location?

Separate

Consolidated

4.

Do you make retail sales of new tires for motor vehicles

County

Telephone (include area code)

within Kentucky?

Yes

No

PAGE 4, SECTION 6 MUST BE COMPLETED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4