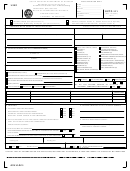

Business Tax Application

Page 3a

(Please print legibly or type the information on this application.)

Section D: Food and Beverage (FAB) Tax Registration (see instructions on page 2)

(No Additional Fee)

Sales Tax Section B must also be completed.

Contact the Department at (317) 233-4015 for more information regarding this tax.

Complete this section if prepared foods or beverages will be sold.

1. Date of first sales at this location under this

ownership:

Mailing name and address for FAB tax returns

3.

(if different from Section A, Line 6):

Month

Year

A

Check if foreign address (see instructions)

2.

Enter the name(s) of the county(ies), city(ies) and/or town(s)

where prepared foods or beverages are sold or catered and list start dates.

B

In care of:

County

City or Town

Starting Date

A

B

C

C

1.

Street Address:

D

2.

City:

3.

E

F

State:

ZIP Code:

Section E: County Innkeepers Tax (CIT) Registration (see instructions on page 2)

(No Additional Fee)

Sales Tax Section B must also be completed.

Contact the Department at (317) 233-4015 for more information regarding this tax.

Complete this section if you will provide lodging or accommo-

1. Date room rentals or accommodations begin

dations for periods of less than thirty (30) days.

from this location:

Month

Year

Check if foreign address (See instructions)

2. Mailing name and address for CIT tax returns (if different from Section A, Line 6):

A

C

B

In care of:

Street Address:

E

F

D

City:

State:

IP Code:

Section F: Motor Vehicle Rental (MVR) Excise Tax Registration (see instructions on page 2)

(No Additional Fee)

Sales Tax Section B must also be completed.

Contact the Department at (317) 233-4015 for more information regarding this tax.

If cars or trucks (less than 11,000 lbs Gross Vehicle Weight) will be rented for less than thirty (30) days from this location, complete this section.

2. Tax District Number:

1. Date motor vehicle rental or leasing begins:

If unkown, contact the County Assessors office.

Month

Year

3. Mailing name and address for MVR tax returns (if different from Section A, Line 6):

Check if foreign address (See instructions)

A

C

B

In care of:

Street Address:

F

E

D

City:

State:

ZIP Code:

Section G: Tire Fee (TIF) Registration (see instructions on page 3) (No registration fee)

Contact the Department at (317) 233-4015 for more information regarding this fee.

Complete this section if you will be selling new replacement tires

1. Date sales begin from this location:

and/or new tires mounted on motor vehicles.

Month

Year

2. Mailing name and address for TIF returns (if different from Section A, Line 6):

A

Check if foreign address (See instructions)

C

B

In care of:

Street Address:

E

F

D

City:

State:

ZIP Code:

1

1 2

2 3

3 4

4