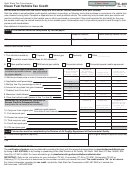

Arizona Form 313 - 2001 Alternative Fuel Vehicle (Afv) Credit Instructions Page 4

ADVERTISEMENT

F

F

o

o

r

r

m

m

3

3

1

1

3

3

Incremental Cost

New or Used Vehicle

Use the following information to determine whether your

Use the chart below to determine how to figure the incremental cost.

vehicle is a new or a used vehicle.

Type of Vehicle

How to Figure the Incremental Cost

New

A new vehicle is a vehicle that was never registered

Factory

The incremental cost is the amount by which

Vehicle

and titled anywhere before its conversion to operate

Manufactured

the cost of the AFV exceeds the cost of the

on alternative fuel. However, a new vehicle includes

LEV,

ULEV,

same model of conventionally fueled vehicle

a vehicle that is converted after the vehicle is

ILEV, SULEV

that is similarly equipped. This is the cost of

registered and titled, if the taxpayer ordered the

the alternative fuel option.

conversion of the vehicle when the taxpayer

Factory

For a zero emission vehicle the incremental

purchased the vehicle.

Manufactured

cost is assumed to be $10,000 or 25% of the

Used

A used vehicle is any vehicle other than a new

ZEV

cost, whichever is more.

Vehicle

vehicle.

Conversion

In the case of a conversion, the incremental

cost is the cost of conversion.

Part IV - Purchase or Lease of New AFVs

Leased AFV

ZERO. A leased AFV is not eligible for a

credit for the incremental cost.

Lines 5 through 16 -

Actual Purchase Price and MBRP

Use lines 5 through 16 to figure your credit for purchasing or

leasing a new AFV.

Use the chart below to determine the actual purchase price and the

manufacturer’s base retail price (MBRP).

If you have more than three vehicles, complete an additional

Actual

The actual purchase price of the vehicle is the

schedule. The additional schedule should show the same

Purchase Price

amount you paid for the vehicle, including

information that is shown on the form for the first three vehicles.

for the

dealer options and a reasonable dealer prep

Complete lines 5 through 16 as instructed on the form.

Purchase or

fee, minus the sum of any customer rebates,

Conversion of

factory-to-dealer

incentives,

document

Part V - Conversion of New Conventional

a New AFV

preparation fees, registration fees, title fees,

Vehicles

fleet car discounts, amounts paid for extended

Lines 17 through 28 -

warranties, or aftermarket equipment installed

on the vehicle. For vehicles over 12,000

Use lines 17 through 28 to figure your credit for converting a

new conventionally fueled vehicle to operate on alternative fuel.

pounds gross vehicle weight, this does not

include the cost of any attachment not

If you have more than three vehicles, complete an additional

associated with the operation of the vehicle.

schedule.

The additional schedule should show the same

Actual

If you leased a new vehicle, the actual

information that is shown on the form for the first three vehicles.

Purchase Price

purchase price of the vehicle is the

Complete lines 17 through 28 as instructed on the form.

for the Lease of

capitalized cost minus the sum of any

Part VI - Conversion of Used Conventionally

a New AFV

customer

rebates,

factory-to-dealer

Fueled Vehicles

incentives,

document

preparation

fees,

registration fees, title fees and the residual

Lines 29 through 36 -

value of the vehicle as shown on the lease.

Uses lines 29 through 36 to figure your credit for converting a

For vehicles over 12,000 pounds gross

used conventionally fueled vehicle to operate on alternative fuel.

vehicle weight, this does not include the

If you have more than three vehicles, complete an additional

cost of any attachment not associated with

schedule. The additional schedule should show the same

the operation of the vehicle.

information that is shown on the form for the first three vehicles.

Manufacturer’s

MBRP

is

the

total

price

on

the

Complete lines 29 through 36 as instructed on the form.

Base Retail

manufacturer’s

invoice

minus

any

Price (MBRP)

destination charges.

MBRP does not

Part VII - Total Current Year’s Credit

include any dealer add-ons or other added

charges. In most cases, MBRP will be the

Line 37 -

list price shown on the Arizona title and

Add the amounts on Part IV, line 16, Part V, line 28, and

registration. In the case of a vehicle with a

Part VI, line 36. Enter the total.

gross vehicle weight of over 12,000 pounds,

Part VIII - Lessor/Lessee Agreement

MBRP does not include the cost of any

attachment not associated with the operation

Lines 38 through 46 -

of the vehicle.

If you have entered into a lease agreement for the AFV, the

Gross Vehicle Weight

lessor may claim a share of the credit for the vehicle as

Use the following information to figure the gross vehicle weight

provided in the lease agreement. The total credit allowed to

of your vehicle.

be taken between the lessor and the lessee cannot be more

The gross vehicle weight is the amount shown on the affidavit

than the total credit allowed for that vehicle.

you

received

from

the

Arizona

Department

of

Complete lines 38 through 46 as instructed on the form.

Commerce/Department of Revenue, unless that amount was

based on misrepresentation by the claimant.

4

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6